Startup Jedi

We talk to startups and investors, you get the value.

The most popular, recognized and widely used financial instruments for investing in early stage companies and startups are convertible notes (convertible debt) and alternatives: SAFE (from Y Combinator) and KISS (from 500 Startups). Each of them has its own peculiarities and requires certain conditions to be met.

Startup Jedi

We talk to startups and investors, you get the value.

Most often these tools are used at early stages of startup development, when it is difficult to determine a valuation of a company — that is, at the Pre-seed and Seed stages. The reason is that the amount of investments at these rounds is small; therefore it isn’t economically viable to spend money on legal services to issue shares, to change the charter, to create additional agreements such as shareholders agreement, to sink into AML (Anti-money Laundering)/CFT (Countering the Financing of Terrorism), etc.

The main cases when convertible notes are used include:

In Angel funds (individual or syndication) before equity round (i.e. usually before Series A, when serious VC funds with large sums of $1m and more enter);

In tranches (for example, a fund is interested in a startup so that it’s willing to give $200k to test the hypothesis, and if the test is passed, it immediately invests another $800k).

In Bridge financing (which is used in case the company has spent all the funds received in the previous funding round and no funds are available to tide over until the next round, or if additional time is needed to increase the valuation of the startup before the next funding round).

Let’s have a look at the example.

Suppose there’s a startup with a mediocre MVP, a showy presentation and the company was registered just yesterday. With all these the founders come to an investor. The investor is inspired by the idea and decides to give $200k to the startup to refine the MVP and test the product market fit at $1.5m pre-money Valuation Cap, 30% Discount, Maturity Date 12 months, Maturity Cap $1m and Interest rate 7% (all these terms are explained below).

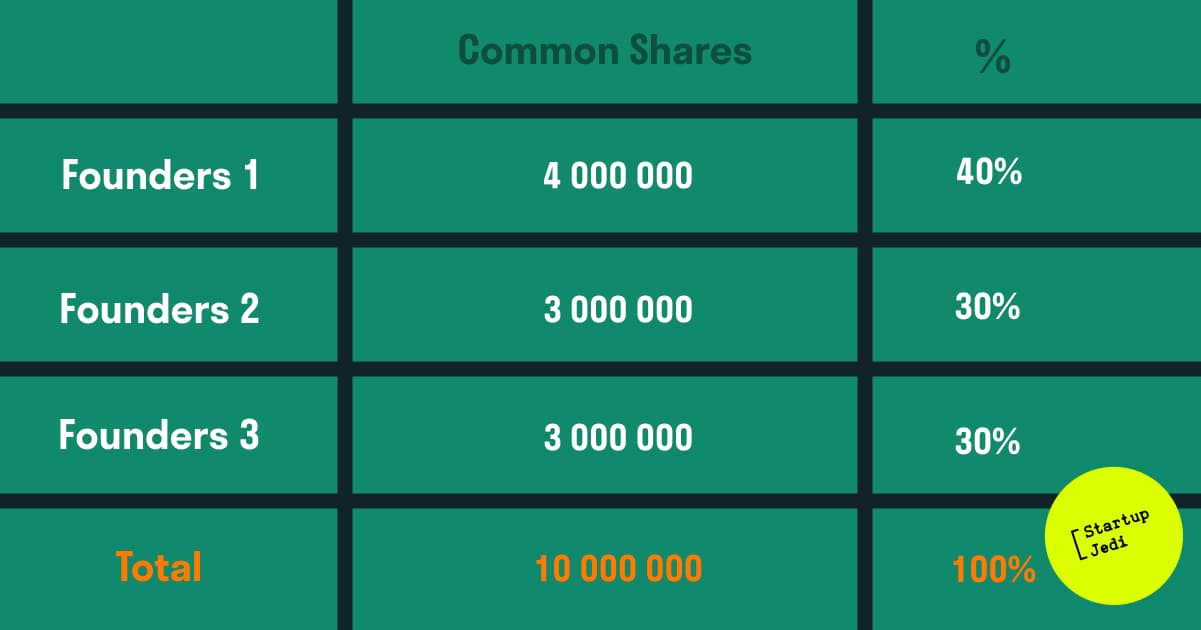

From the very beginning, the founders MUST track their Cap Table lest the situation turns out when 50% of the company’s shares have already been distributed prior to the equity round (Series A, for example). Therefore, let's suppose 10 million shares will be issued for 3 founders.

Question: What document should be signed so that an investor could both transfer money to the company’s bank account and get his share at the equity round? Option 1 — Convertible Note.

...

The Basics:

Convertible Note is an investment as a loan. An investor has the right to exchange the investment for shares or return it back with interest, whilst for a startup it is an opportunity to get money as quickly and easily as possible.

Convertible Note structure:

Interest rate. There are 3 ways to use an interest rate:

a. charge interest when returning a payout of the loan

b. charge interest when converting a loan into shares or equity in the company

c. points a+b

For example: the startup account received a $200k investment with an interest rate of 7% (annually) when the loan is repaid (this may occur if the startup becomes bankrupt or doesn’t reach any of the specified KPIs or other cases contained/defined in the contract come into force) after the Maturity Date (e.g. a year), the company returns $214k to the investor.

Maturity Date (Maturity) is the repayment date/ the date on which the final payment is due on a loan. Repayment may be in the form of conversion or repayment of the loan with interest to investor. Usually Maturity is set between 12 and 24 months. The conversion may occur before Maturity, if an equity round takes place.

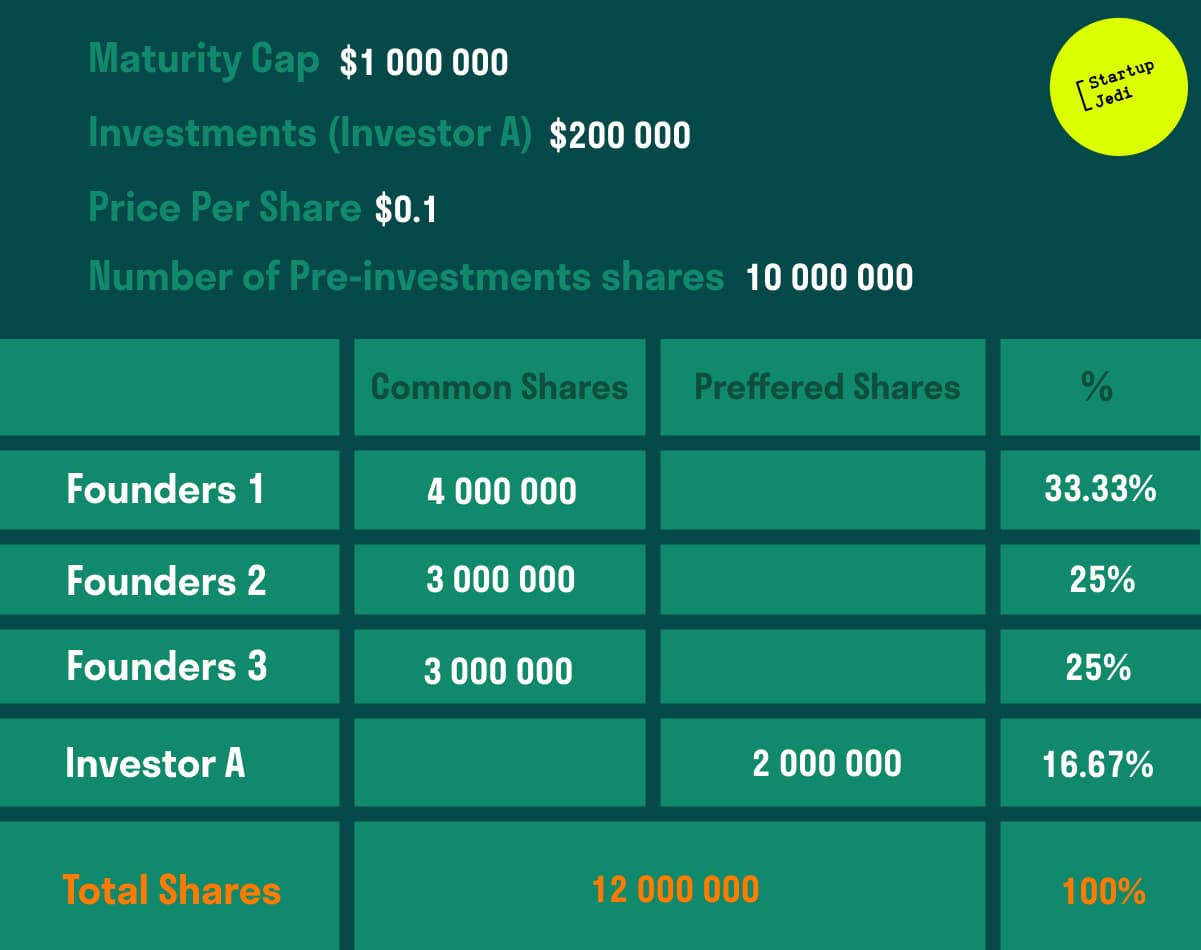

Maturity Cap — an economic value of a whole company that is converted into shares once the Maturity Date is reached and Valuation Cap is not applied (unless equity round has been completed before Maturity).

Maturity Cap is usually equal to either Valuation Cap or lower for risk-reward investors (the investor’s reward for the risk of early-stage investment). For example, Valuation Cap = $1.5m and Maturity Cap = $1m, so, after Maturity an investor receives 16.67% of equity in the company in accordance with Maturity Cap. Thus, with such a percentage the investor is interested in helping the startup further. Or you can talk to the investor and ask him to extend the loan on the same or even better terms.

Conversion Valuation Cap sets the maximum possible valuation of the company on the euqity round. Consider a hypothetical pre-money valuation is $1.5m (this is our assumption of what the equity round valuation will be). We need this figure for a situation if a startup suddenly closes a $2m equity round at a $10m pre-money valuation, in this case our early investment is not diluted.

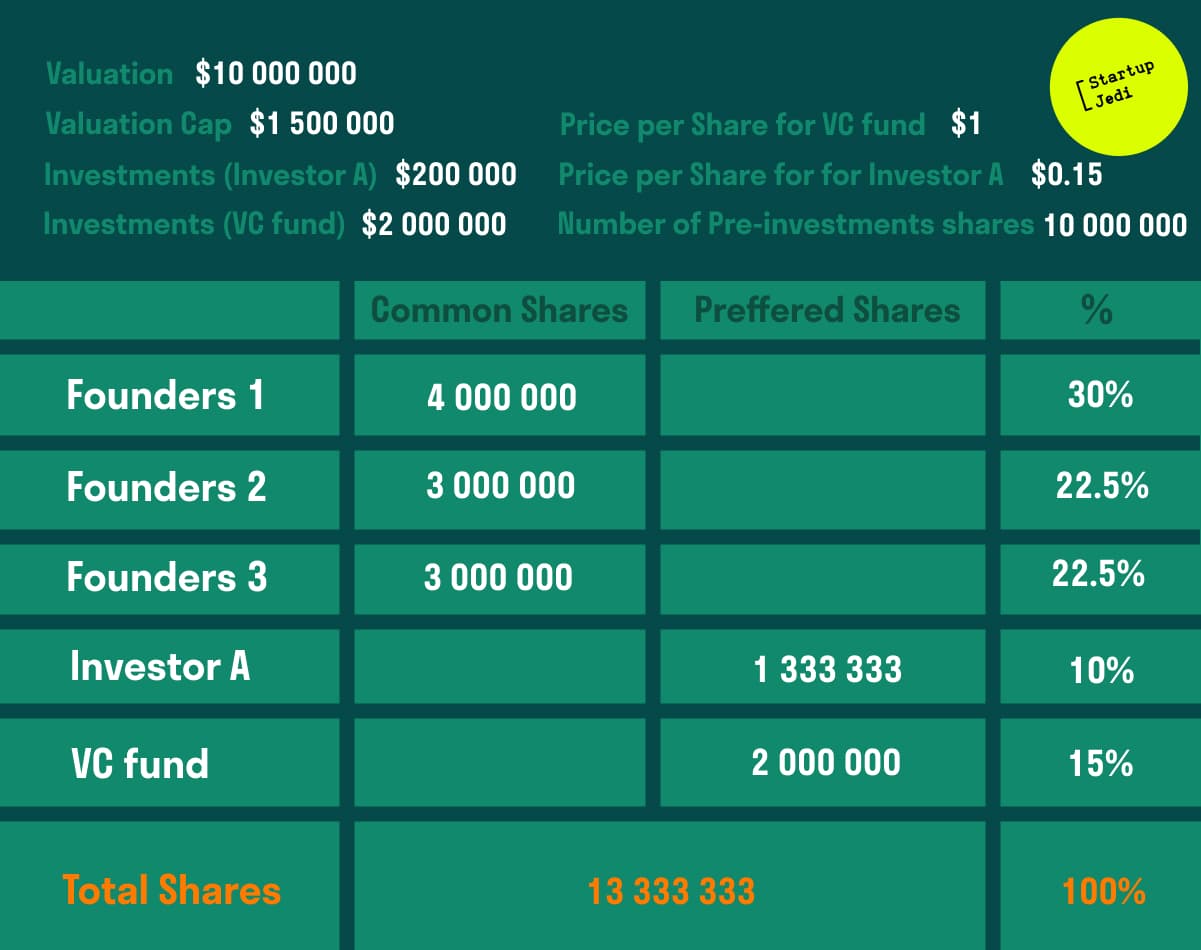

For example: when converting into shares using a Valuation Cap, the investor gets 10% of the company's equity for $200k (whereas the venture fund with $2m investments receives 15%).

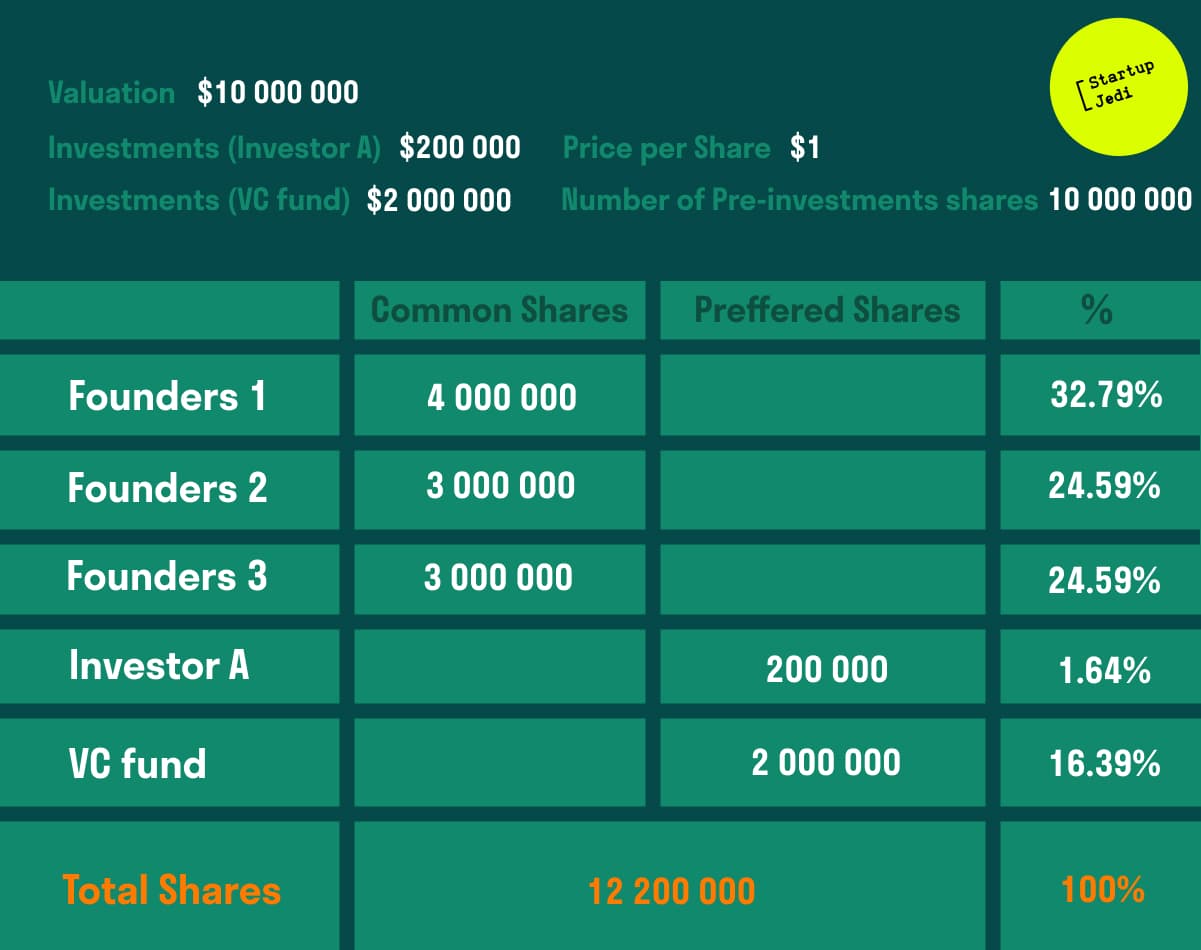

If we count without the Valuation Cap at a $10m pre-money valuation, the share would be 1.64%.

Discount for an investor is used when converting a loan into shares. The discount is given for the faith in a startup at the very beginning of its journey. Usually 10–30% is used.

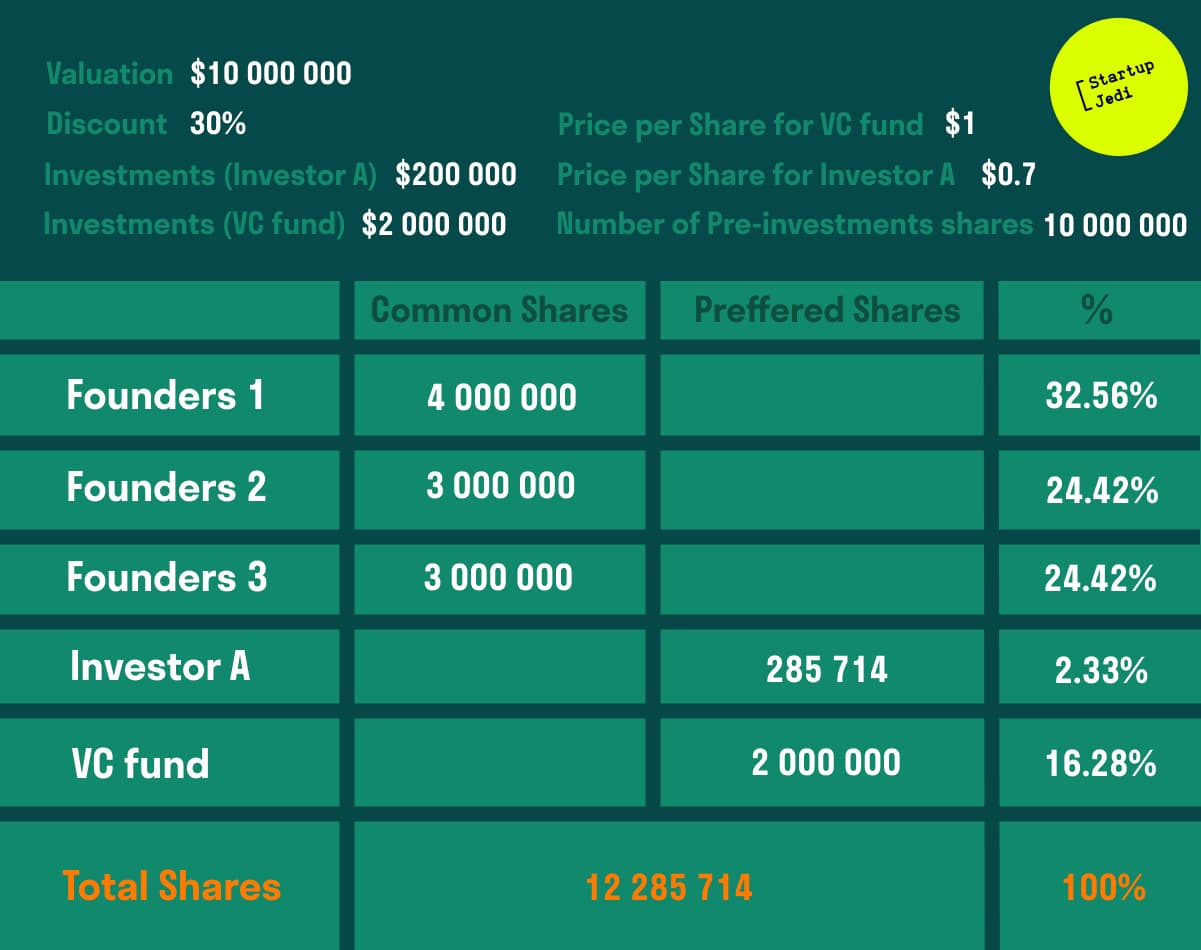

For example, an investor invests $200k with a 30% discount. So, at the equity round at a $10m pre-money valuation with $2m investments, investor will receive 2.33%.

Without the Discount, the investor gets 1.64%, just as in the case without Valuation Cap.

This causes the dilution of the percentage the investor gets. For this reason, the investor will choose a convertible note with the Valuation Cap, rather than with the Discount, so that to get 10% of the company, rather than 2.33%.

Now, let’s do another numerical example and calculate how much an investor would receive under the following conditions of the convertible note: investment of $200k with Valuation Cap of $1.5m pre-money, 30% Discount, Maturity date 12 months, $1m Maturity Cap and 7% Interest rate.

After 12 months, at the equity round the startup raises $2m funding at a pre-money valuation of $10m and issues 10 million shares (the number of shares can be any, but usually 10 million are issued, because if 1 share becomes expensive, you will have to make an additional issue, as it’s impossible to split the share). So, your share will be worth $10m/10 000 000 = $1.

Given the interest rate is 7%. The investor has invested $200k+($200k*7%) = $214k. You can choose the price per share in accordance with either a Valuation Cap or a Discount. If we apply the Cap, the price per share = $1.5m/10 000 000 = $0.15. If we apply the Discount, the price per share = $1*0.7 = $0.7. Surely the investor chooses the price by Valuation Cap and now he owns $214k / $0.15 = 1 426 667 shares (figures are always rounded off by mathematical rules).

If the investor had entered the equity round, he would have only $200k/$1 = 200 000 shares. The difference of 7 times is the reward for an early investment =).

In case nobody closes the round after 12 months, Maturity Cap is triggered. That is, either the investor withdraws/returns $214k (initial investment plus interest rate), or he receives shares/equity calculated counting the Maturity Cap, then the share price is worth $1m/10 000 000 = $0.1. And the number of shares owned by the investor = $214k/$0.1 = 2 140 000.

Sometimes there are cases when Maturity Date and equity round are not yet due and the company is sold, then most often the conversion is at the price per share at Maturity Cap or at the price of the share at the sale. In some cases it is included that the investor can receive 2x to his investment + 2x to Interest rate.

Furthermore, convertible notes may contain other terms:

Information, i.e. request for financial data or updates.

Right to vote.

A board seat/ a seat on a board of directors, often non-voting.

Pro-rata right — it means that the investor will be able to invest in future financing rounds (following the first equity round) to keep his share, because with each new investor, the share gets diluted.

Most-favored-nations — if after the execution of a convertible note a subsequent investor appears with whom another convertible note is signed on more favorable terms (for example, above Interest Rate, below Cap, etc.), then the first convertible note holder may elect to inherit the future conversion of shares on more favorable terms of the agreement of the second investor.

Use of Funds — a plan for spending money.

No pre-payment — until the conversion event, you can't repay the debt, because the investor expects to increase his investments in the future and is not interested in withdrawing the money at once.

It’s also possible to require the formation of a specific legal entity: for example, the conversion of shares must take place in C-corp (for the USA). This is likely to be the insistence of subsequent investors, but it can be written in the convertible note as well.

Market Stand-Off — A ban on selling shares within a specified period of time after a conversion into shares.

The advantages of a convertible note:

Postpone a valuation of a company until later.

Very modest expenses on Legal.

The main drawback:

- Maturity Date is less favourable for a startup than for investors because stocks may be converted at a low cost, while, on the contrary, for an investor, it is a kind of protection: if the startup fails to reach the desired performance up to Maturity Date, the investor can either receive back his investment (very rarely) or convert into a larger share.

In the following articles of the series, we will analyze the mechanics of other popular tools: SAFE and KISS.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments