Startup Jedi

We talk to startups and investors, you get the value.

Despite the coronacrisis, the venture capital market is not resting, we’re still observing how growing startups attract large rounds, big players acquire new companies in their ecosystems and new projects acquire unicorn status. Businesses are adapting and online is gaining the upper hand. We’ve gathered the 3 biggest news of the past week for you.

Startup Jedi

We talk to startups and investors, you get the value.

Perhaps this is the main deal of the week. Giphy is a web-based system and platform for searching for gifs. A leader in the field of visual expression has already become the main source of animated content and half of all traffic just came from Facebook resources: Instagram, Messenger, WhatsApp, Facebook application.

With the purchase, Giphy will become a part of the Instagram team and will continue functioning both on other Facebook platforms and on third-party services: users will be able to upload their gifs while developers and partners will use the API.

What does this mean? This means that after MSQRD Facebook is ready to buy what keeps users within their products and adds fun. The estimate is a bit strange provided that the project has already raised $ 150 million. People love gifs, people share gifs and people are ready to create gifs, it’s an absolutely logical purchase for Facebook in terms of strengthening their ecosystem.

...

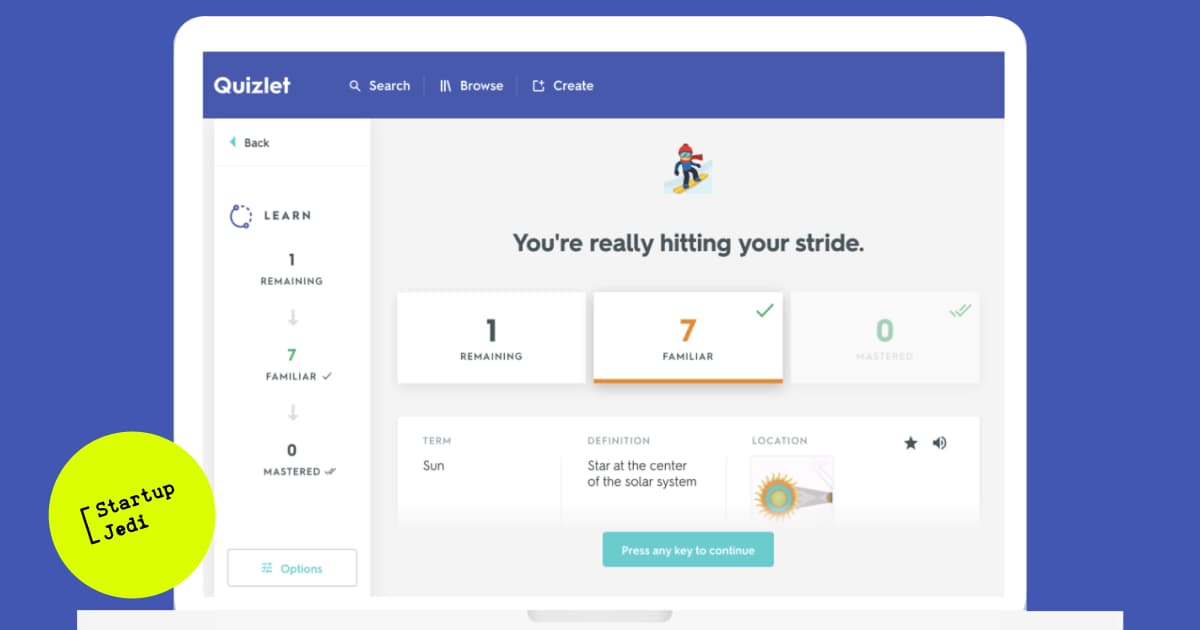

Quizlet, a San Francisco-based startup founded in the distant 2005 by a 15-year-old teenager, makes it easy to remember information using training cards: you can find them in the database or create interactive material by yourself, add audio files to the cards and then do exercises or play games — to learn new material.

The service raised $ 30 million in round C with the help of the background of the global transition to online, the lead investor of the transaction was General Atlantic, a private investment company. Since 2018, the company’s value has increased 5 times reaching the mark of $ 1 billion and thereby guaranteeing the startup the unicorn status. The total investment in the company nowadays is $ 60 million.

What does this mean? In coronavirus times millions of people were rushed to learn something new with the help of new tools. Startup audience growth during the pandemic was 200–400%. This product is used by more than 50 million people worldwide. In the near future we will see many more new unicorns who are trying to saddle the topic of training on the network, there is still a lot of free space for new players. Moreover, after the coronacrisis and the removal of the almost global lockdown, it is unlikely that people will fully return to their usual offline activities, many new activities have already entrenched themselves in the network including the consumption of educational content. Therefore, the edtech market will continue growing.

...

With the beginning of the pandemic the demand has grown not only for online education, but also for food delivery services :)

Uber offered to buy the GrubHub food delivery service — the deal could become a consolidation of the two largest US delivery services. According to Edison Trends, in April, Uber Eats accounted for 25.7% of the total expenses of Americans on food delivery while GrubHub accounted for 22.8%, and DoorDash leaders — 46.5%.

What does this mean? In the pandemic mode, interest in projects that allow delivering food home has very much increased since people are physically unable to go to a restaurant. Although Uver has suffered from the coronavirus by announcing massive layoffs of employees and offices, Uber Eats looks confident against the backdrop of highly unprofitable destinations. If Uber completes the deal successfully, it will become the new leader in a very attractive market. We are waiting for new deals that should consolidate the market. It will also be interesting to watch the actions of the American antitrust regulators and their reaction in the context of the upcoming transaction.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments