Startup Jedi

We talk to startups and investors, you get the value.

Investment companies use a variety of services in their work to coordinate different areas: for project management, tracking metrics and building business processes. In practice, the number of programs the fund works with reaches 10, 15, and in some cases even more. This is no doubt inconvenient. Managers in the PE / VC markets are increasingly willing to accept and use modern technologies. And since there is demand, there is supply. By 2025, the global investment management systems market will reach $5.76 billion!

In this article, we will see what software for investment companies there is now and how they work.

Startup Jedi

We talk to startups and investors, you get the value.

Fund management software solutions help professional investors perform their daily work better. Such software is used for portfolio management, auditing and compliance, LP onboarding, generating financial statements, and displaying the main metrics of the fund.

...

The market offers a number of services for investors and investment funds, the purpose of which is to simplify and optimize work with the portfolio, accounting, interaction with companies and partners.

Allvue solutions help to optimize work processes and improve efficiency in a number of areas where there is investment activity: fund administration in a broad sense, lending, family offices, funds of funds, venture capital, real estate.

Allvue is a software for working with investment information, which allows, among other things to:

Manage portfolio;

Maintain investment / stock / corporate accounting and manage funds;

Manage the pipeline;

Carry out business analysis;

Work with reporting.

One downside of the software is that there is no mobile application.

To try the software, you can leave a request for a free demo version in the form on the developer’s website.

EquityEffect is a portfolio and capital management platform for venture capitalists. The software can also be convenient for private equity firms and law firms.

The solution allows you to collect all the data on the fund’s performance in one place, regardless of what software portfolio companies use. It also provides for viewing legal data on the portfolio. In addition, EquityEffect makes it possible to:

Simulate project scenarios;

Integrate with a number of systems;

Track KPI.

Disadvantages: lack of accounting management tools.

You can request access to the free demo version of the program through the form.

Software that helps companies and investors manage capitalization data, as well as valuations, investments and capital plans. Like the previous software, the Carta developers have made it convenient for lawyers.

Some features of the software are:

Fund administration;

Scenario modeling;

Portfolio management;

Audit.

One disadvantage of the software is the lack of tools for working with leads. You can leave a demo request here.

Software for investment companies that automates workflows and data management. The platform offers industry-specific multifunctional solutions. Among them are:

Deals management;

CRM and IRM;

Data integration and analysis;

Reports (more than 100 varieties).

The solution has a mobile platform, so the software can be used from a tablet or smartphone. You can leave a request for a demo version through the service website.

The developer has a number of software for hedge funds, funds of funds, private equity funds, funds specializing in real estate. The solutions allow, among other things, to carry out:

Fund administration;

Working with taxes;

Risk calculation;

Preparation of financial statements for the fund.

Notably, Citco has products designed for specific customer segments. For example, Æxeo® Investor is a software that simplifies the calculation of commissions based on assets (management fees, incentive payments, storage fees), and automates the distribution of income.

AIRR is a service for managing investment business, which is a unified platform for monitoring and forming any investment portfolios. AIRR developers have tried to solve the problem of forced work with many programs by developing a single SaaS solution.

AIRR has a web version and mobile app that are available for Android and iOS. AIRR brand combines three products: AIRR portal and two junior products: AIRR Metrics (to collect data from portfolio companies) and AIRR Leads (to automate work with leads and track the funnel — from the moment they appear to work with the current pipeline).

The platform allows you to synchronize the work of each participant in the investment process. Investors get online access to their portfolios with the ability to assess their value here and now. Analysts can use a convenient tool to find new companies through the automated filtering system of the project funnel. Lawyers can conduct onboarding of investors remotely, as well as store all the necessary project documentation. CFOs can monitor the current financial condition of the portfolio, both for the respective holding structures, and at the level of each portfolio investment.

To access the free AIRR demo, just leave a request here.

...

Using AIRR as an example, let’s see how the software for investment funds works.

According to the developer, the idea of the project was initially to create a common service for managing all fund operations. The user in AIRR can integrate and combine data from the systems he uses. For example, integration with a number of CRM, Business Intelligence systems, accounting programs, programs that work with stock data, DocuSign for signing documents with investors, applications for lead generation, and collection of metrics are configured here. Pipedrive, Salesforce, Xero, PowerBI, Qlik — there are more than 18 integrations at the moment.

Customization is provided if the fund uses some systems that AIRR does not have integration with. Almost any system that has an API can be linked to the platform. AIRR supports 5 languages: English, Russian, French, Chinese and Spanish. At the request of the client, the interface can be translated into other languages.

AIRR’s clients are private equity funds, venture capital funds, investment holdings, family offices and angels. In the future, the platform’s functionality will be expanded taking into account the interests and needs of professional managers working in other investment grades: real estate transactions, public markets, investments in other funds (Funds of Funds), etc.

The platform can be used by both the fund’s team and the fund’s investors, that is, both GP and LP. LP gets access to the portal with the opportunity to see the following sections: Own investments, Investment companies, Pipeline. The GP, in addition to these sections, has access to settings where all data is entered and managed from.

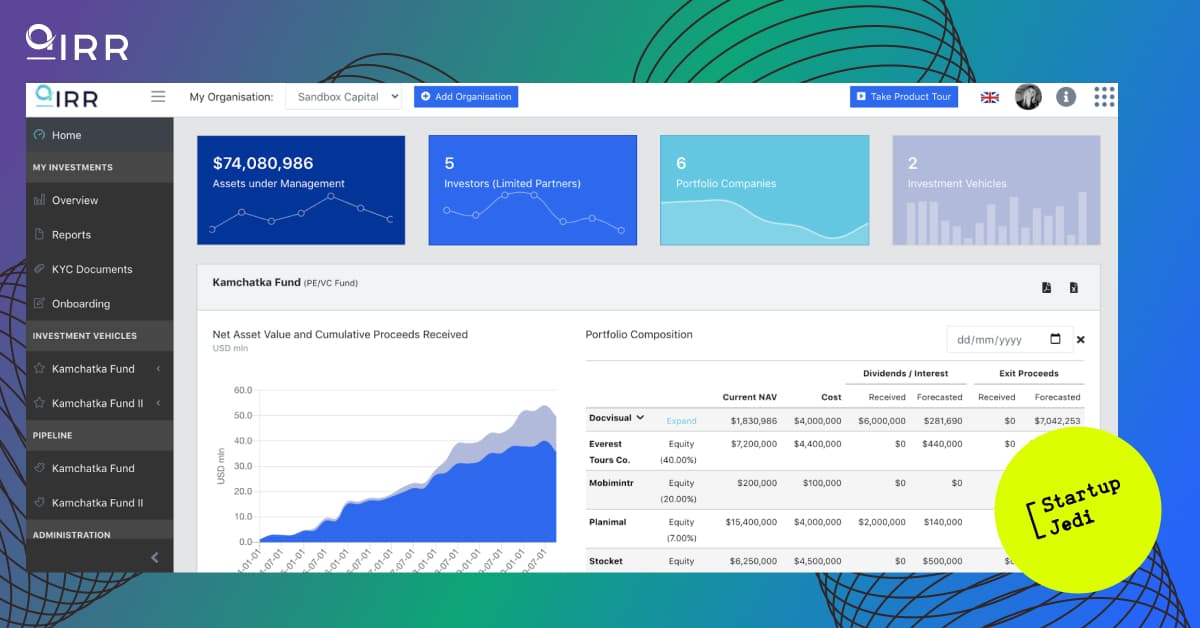

The main page contains general information about the organization. If a client has several investment funds, all of them can be maintained in a single system, information will be displayed for each of them separately. The client sees general statistics of the organization: assets under management, the number of portfolio companies and investors, metrics for the fund, as well as all the data on the portfolio: how much money is invested, what is the share, how many dividends are paid, etc. You can, for example, also see the state of the portfolio, the so-called NAV (Net Asset Value — Startup JedI) for a certain date in the past. It also provides the ability to generate instant reports: both in Excel-format and in pdf.

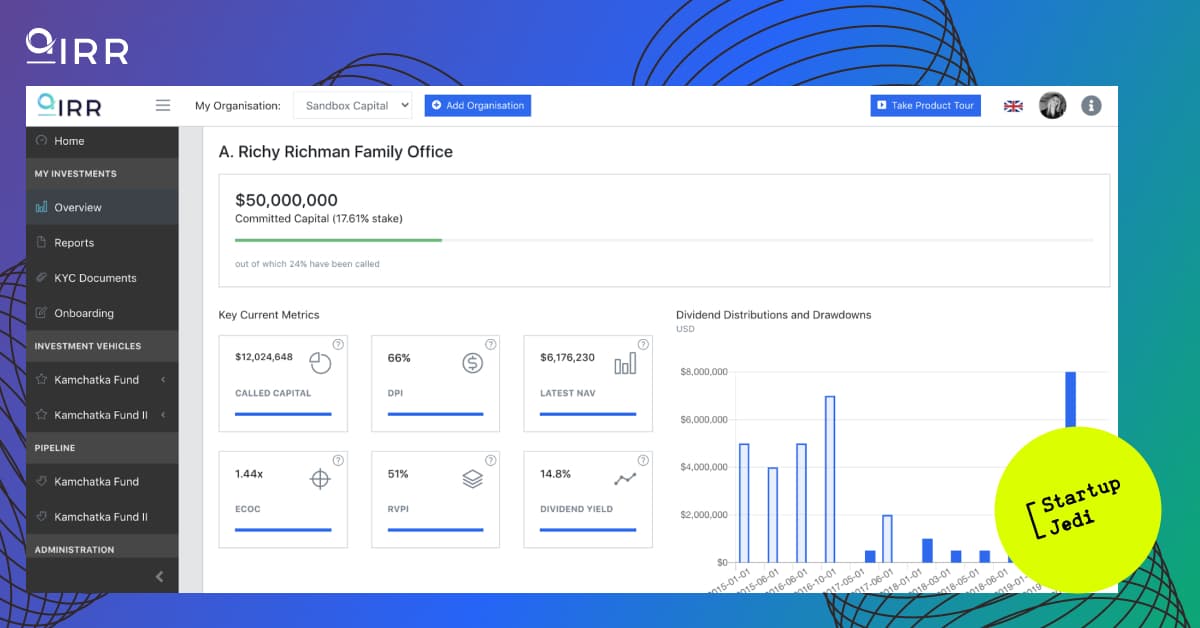

This section provides an investor with an opportunity to see data on his investments. Raised investments, capital call, last NAV, dividend yield and other metrics, as well as dividend distribution and transfers. The fund manager can check this information for each of his investors.

GP can store all the necessary documents in a structured way. Files can be attached to both an investment and a portfolio company, directly to an investor, investment or obligation, thereby enabling the investor and fund team to find the required data quickly and easily.

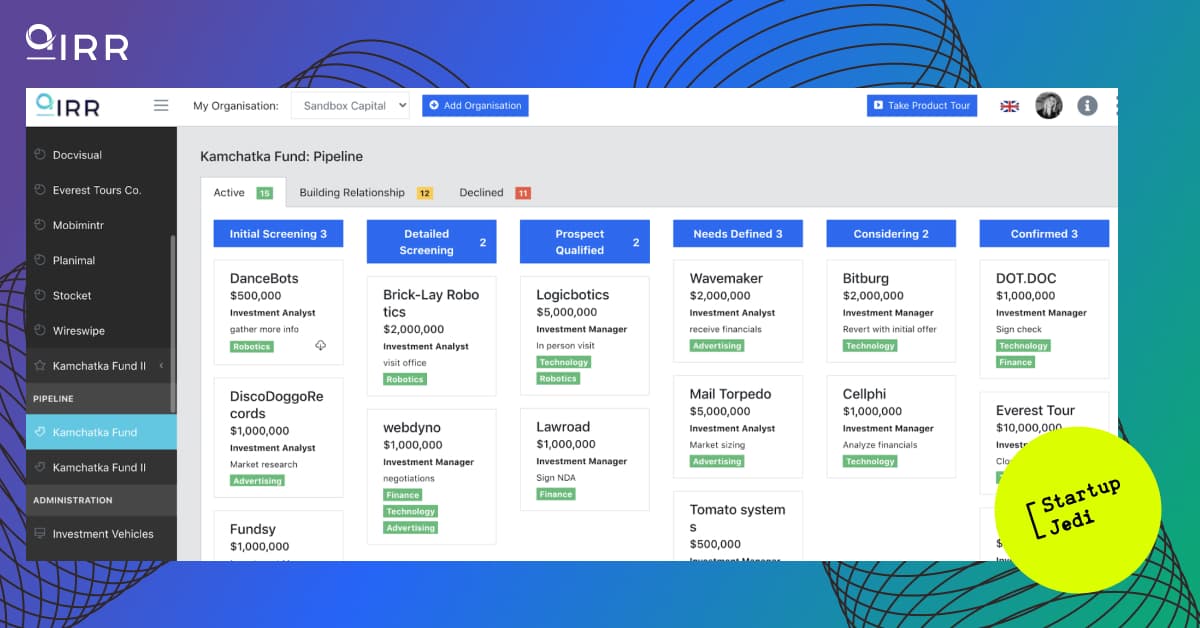

You can show investors any companies that the fund team is considering. All stages of the project funnel are easily customizable.

If the fund integrates CRM, two-way synchronization is enabled. Thus, if the stage where the company in question is in one system changes, the information automatically changes in the other. If the fund does not want to show the pipeline to investors, this option can be disabled. In addition to synchronization with CRM, it is possible to enter data manually.

The main feature here is that a lot of data is entered into ordinary CRMs, which funds are not always ready to show to investors, since they contain sensitive information for internal use. AIRR also contains maps to display for LP — with basic information that they can look at without the nuances that the fund tracks itself.

The service has a lead generation feature. This functionality is available both on the main platform and as a separate product — AIRR Leads.

The Fund can connect any databases it uses: CrunchBase, PitchBook, Parcers and others. Then, directly from the platform, it can search for the leads that it needs.

You can work with filters that can be configured by company, by the last round, by investor. Additionally, you can enable synchronization: in this case, when new companies that meet the fund’s requirements appear in the database, the fund’s team will receive a notification about this, which decreases the opportunity to miss a potential lead.

Companies of interest can be saved to leads and transferred to a list maintained in the system. All leads from connected sources are collected here. If everything is currently being done in Excel, you can import leads from there. Of course, you can change any information on leads that are in the system. You can also add leads manually.

Another option is to get leads through a Web-to-Lead form, if the fund has its own for that companies use to pitch projects through a website or social networks. The data will go directly to the AIRR system.

Based on all the leads received, the team then forms a pipeline of the fund, which can be shown to its investors.

Collecting financial data from portfolio companies is the pain of many investment funds. AIRR has several solutions to this. Firstly, you can enter data manually, and secondly, you can configure the receipt of information through the API — in this case, data from BI systems of companies will automatically appear on the platform. Thirdly, you can connect Google Sheets, when filling in which, the configured metrics will automatically appear in the system.

Another, perhaps the most convenient, option is the junior product AIRR Metrics. Its idea is that the fund team sets up the metrics that need to be collected from portfolio companies and provides companies with access to the platform. The cool thing is that the system sends companies forms to fill out automatically: weekly, monthly, quarterly, annually.

In the future, it will be possible to make automatic reminders. If the fund has many portfolio companies, you can have the platform automatically send them reminders as often as needed, until the company enters the required data into the system.

All the data that is available to investors on the site can also be viewed through the interface in the mobile application: data on the fund, pipeline for each portfolio company, any documents to which there is access. But it is not yet possible to load data through the mobile application, this can only be done through the website.

The subscription costs $500 per month for the organization. This package provides for an unlimited number of investment companies, funds, holdings, portfolio companies, an unlimited number of users — both LP and GP.

There is a 20% discount on an annual subscription. The service provides the ability to develop additional functionality at the request of the client, and also offers an on premise solution if you need to build an infrastructure on the client’s side. The cost of functional improvements is calculated on an hourly basis, depending on which integrations and which improvements are required and are discussed directly with the client.

...

There are many solutions on the market for those working with investments. Such software is designed to save time for fund employees and investors, simplify communication and cooperation with portfolio companies and partners. Among the software there are both universal (the developers tried to cover the entire pool of needs of investment funds), and specialized (solving a number of important tasks in a certain direction). The demo version is usually free and available upon request. The total cost depends on the business model the owner of the software chose.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments