Startup Jedi

We talk to startups and investors, you get the value.

Startup Jedi

We talk to startups and investors, you get the value.

Is this summer full of venture deals? Definitely! Today we will consider:

What is special and unique about Macro’s video calling solution which is focused on Zoom,

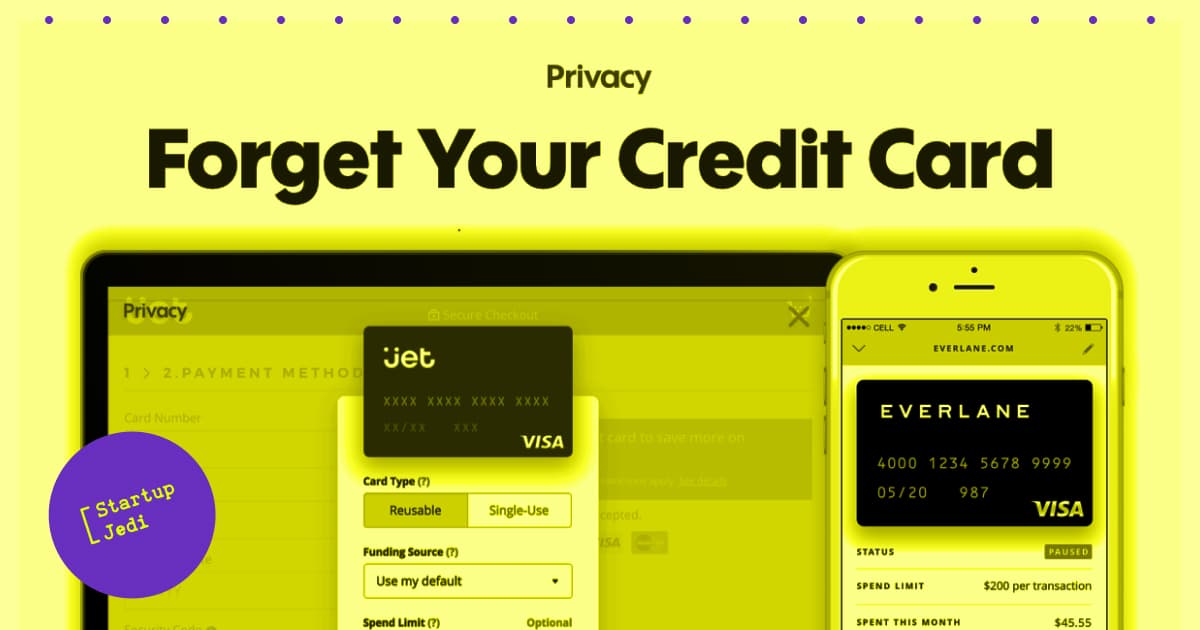

Why is the Privacy.com virtual card generation service so popular,

How CampusLogic helps schools and students effectively address tuition fees and grants,

What is the reason behind the growth of the high demand in the RPA market and how UiPath is growing now,

Why SocialChorus uses the mechanics of organizing external advertising campaigns for internal communications in corporations.

...

The American startup Macro is jumping into a niche just in time, striving to capitalize on Zoom’s capitalization into a pandemic — clearly capitalism. Macro is a free video call add-on for Zoom that allows you to customize the background, the interface for mirroring colleagues, take notes, track the engagement of call guests and prepare a general summing-up. By building their own app on Zoom’s SDK, the Macro team can completely customize the interface and analyze the effectiveness of rallies without worrying about video and audio infrastructure or platform’s scalability.

One of the advantages is that the Macro team focuses on personal experience, not on a corporate one, counting on a viral effect: so that you do not need to persuade the whole team to install Macro, this is a personal choice of each conference participant (but a positive experience should also be an interest of other participants in installing the service naturally).

Today Macro is used by over 25,000 users who have already made over 50,000 calls.

The startup’s total funding to date is $4.8 million since its launch in 2018. The amount of the Seed round is 4.3 million from FirstMark Capital, General Catalyst and Underscore VC, among other investors who took part in the round are NextView Ventures, Jason Warner (CTO GitHub), Julie Zhuo (former VP Design Facebook), Harry Stebbings (Founder / Host 20minVC), Adam Nash (Dropbox, Wealthfront, LinkedIn) and Clark Valberg (CEO Invision).

What does it mean? A large project always gives birth to many smaller young players next to it. Zoom has grown incredibly, and the guys from Macros have developed a cool SDK add-on Zoom, which now allows you to do a lot of cool things: monitor the activity of each participant and their interactions in the form of a general chat, leave questions and write takeaways right inside the interface (which, by the way, are immediately transformed into Google doc), organize work meetings or major presentations. Of course, it’s scary to build your business on someone else’s SDK, but it’s still better to take a risk on a fast-growing project than “warm the universe” for years, especially if among the plans are to use this solution not only in Zoom. It is a vivid example of how you can grow due to a trend and a specific situation.

...

Privacy.com, despite its name, protects not only the client’s private data, but also their money. The service allows you to generate virtual one-time cards for online purchases for free to keep the actual card number safe. In addition, you can set the cards to self-remove, and install the web extension to autofill billing information. This idea turned out to be very relevant, over the past 3 years the startup has generated more than 5 million card numbers.

In the new round of investment, the startup raised $10.2 million, the deal was led by the venture fund Teamworthy Ventures, Index Ventures. Exor Seeds also took part (both funds, incidentally, invested in the startup in the Seed round in 2016) as well as Tusk Venture Partners, Quiet Capital and Rainfall Ventures. In total, $12.4 million has been invested in the startup to date.

The startup will direct this round of funding to release its own API for issuing virtual cards. This solution will allow corporate clients to issue virtual cards and manage employee expenses through their own back-end systems.

What does it mean? Card creation speed and data leakage are huge problems. Cards also cease to be physical elements, “plastic” has a number of disadvantages: it must be ordered, there are time limits + often attackers use data. A smart API helps you not to show really important data, but to generate one-time PIN codes on the go. We are waiting for big steps from Apple and Google in the near future, something tells me that the future of the banking sector will go to digital giants, nevertheless, linking an account to a phone looks more organic.

...

CampusLogic is a complete edtech solution currently used by 15 million students in 750 US educational institutions. The platform includes a tuition cost calculator, full scholarship management functionality, personalized 24/7 advice, tools for simplified verification of financial aid and even scholarship crowdfunding.

The startup was founded in 2011 and has since raised $192.8 million of investments. Dragoneer Investment Group has invested $120 million in CampusLogic and this is the largest investment in the company of all times. Following the deal, Christian Jensen, Partner at Dragoneer, will join CampusLogic’s board of directors.

The new funding will be directed towards the acquisition of new strategic partners and further product development.

What does it mean? The US educational system is very complex and highly bureaucratic. Someone had to solve issues related to tuition fees, loans, receiving timely information and assistance in debt restructuring. It is very beneficial for universities to use a single solution, since many of them lose their students due to the fact that they simply cannot find the information they need on the old university websites.

...

UiPath, the RPA market leader and a Romanian unicorn, announced a $225 million E round with lead investor Alkeon Capital. Accel, Coatue, Dragoneer, IVP, Madrona Venture Group, Sequoia Capital, Tencent, Tiger Global, Wellington and T. Rowe Price Associates, Inc also participated in the round. Thus, the total amount of investments in a startup to date is more than $1.2 billion.

The startup uses AI bots to solve frequently repeated back-office tasks: registration and accounting of operations related to the company’s finances. RPA helps companies get rid of outdated manual labor and automate and digitize standard processes. The pandemic gave its impetus in this direction, because now more and more companies are now striving to find the optimal fast automation options.

What does it mean? RPA is growing at an incredible rate! Automation of processes allows you to greatly reduce costs and be more competitive. The situation was aggravated by the coronavirus crisis, the UiPath team had an incredible increase in revenue: from $100 million to $400 million in 24 months! UiPath allows you to automate internal processes without breaking the old model, the demand for the service seems to be really overwhelming. The old saying “Change or die” I would replace with “Automate or die”.

...

SocialChorus is a kind of CRM for communications within a company, the platform helps to improve communication with employees using classic marketing tools: you can launch campaigns for a specific target and segment, analyzing how a particular message is absorbed and perceived by the team.

According to company representatives, SocialChorus now has 120 large clients around the world, 2.5 million users on the platform and 50% annual revenue growth.

Sumeru Equity Partners invested $100 million in the startup, thus the firm acquired a controlling stake in SocialChorus, three representatives of Sumeru would join the company’s board of directors. Apart from the last funding, since its foundation in 2008, the company has managed to raise $47 million in venture capital investments for its development.

What does it mean? As long as the company is all about people, not AI, then you, as a leader, need to address the issue of communications. If several people work for you, then communications are built quite simply. However, with corporations, everything is not that simple: often managers do not understand how their decisions reach employees, whether they understand it, whether they accept it internally, etc.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments