Startup Jedi

We talk to startups and investors, you get the value.

In today’s article, we focus our attention on what the COVID-19 pandemic gave us in the area of digital healthcare and how will the industry develop in the post-pandemic period; we will look into the main tendencies in technology development, startup investments and main development vectors of the digital healthcare market.

Startup Jedi

We talk to startups and investors, you get the value.

COVID-19 pandemic has rippled a significant effect on the digital healthcare industry: it has exposed many vulnerable places in the counties’ healthcare systems and accelerated the implementation of digital models — from virtual patient care to targeted molecule search and drug design.

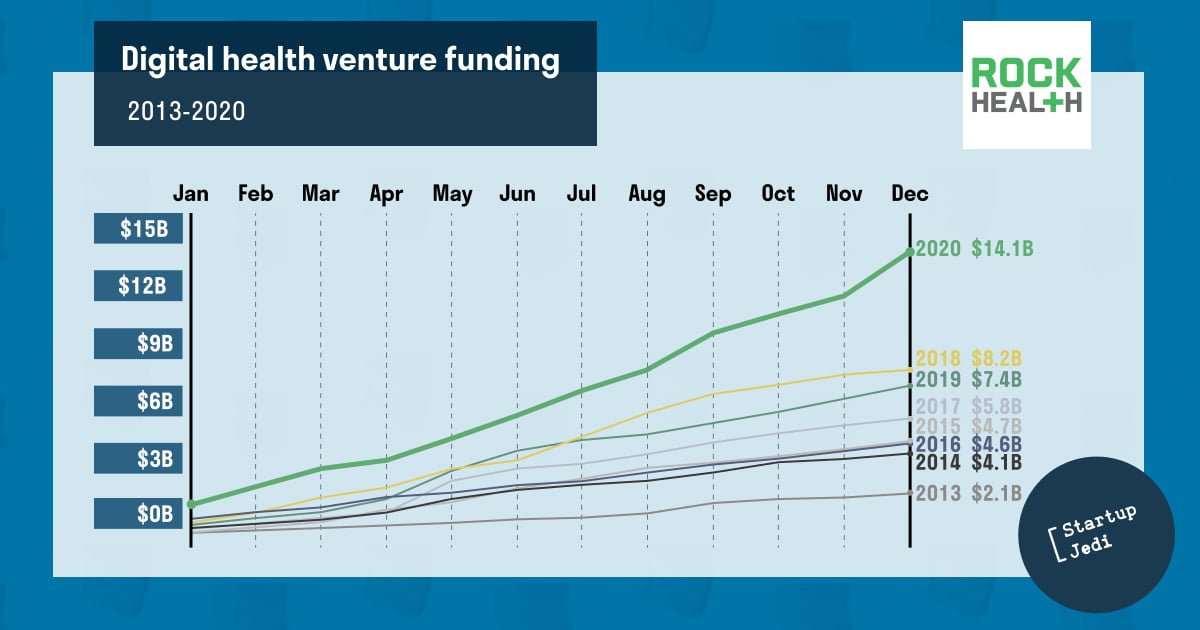

The pandemic has led to the unprecedented inflow of investments into digital healthcare. According to the Rock Health reports, venture capital financing has increased by 72%, and compared to the record high metrics that were set in 2018, it equals $14.1B. Taking into account reports from MERCOM Capital Group, in 2020, telehealth alone has broken the financial records with $4.3B in total.

The total financing volume for the digital healthcare companies, including venture capital and governmental financing, has reached $21.6B in 2020 (with a growth of 278%).

The data indicate that the pandemic effect will have long-lasting consequences for both the whole healthcare system and the IT companies that operate in this sector. At the present time, according to analysts’ estimates, only in the United States with the acceleration of the use of telemedicine and its high demand in general — up to $250B of the country’s current total spending on healthcare can be used for virtual doctor visits, telemedicine services and the development of telemedicine technologies.

...

The infectious nature of COVID-19 has contributed to an increase in the proportion of virtual visits to a doctor for outpatient care. The Healthcare Information and Management Systems Society reports that the number of virtual telemedicine visits has increased from 1–2% to 30%. Moreover, experts predict an increase in the use of telemedicine services to 66% in the total volume of medical services, as well as an increase to 40% of calls for primary health care online.

The TOP-3 financing leaders of this category in 2020 are Alto Pharmacy ($250M), Ro ($200M) и Amwell ($194M).

On the one hand, the increase in the number of inquiries for primary healthcare by means of telemedicine services enables to offload primary healthcare setting and, on the other hand, the increased demand on telemedicine solutions leads to the creation of a full-fledged system with drugs delivery, lab testing, healthcare delivery by medical personnel in-home.

For example, the Israeli telemedicine company TytoCare, which uses artificial intelligence to transform primary healthcare and put it into the hands of consumers, raised $50M in 2020 for its diagnostic and telemedicine platform, and by this, expanded services that can be effectively delivered at home.

The American company Conversa Health, which is a platform for automated help for patients and coordination with medical services, raised $12M in 2020 to improve patient profiling and triage, as well as, the use of artificial intelligence and multiple data sources (biometric wearables, patients’ electronic medical records, various wellness applications and others), which will allow personalizing messages, remind patients to take medications, perform prescribed medical procedures and make general recommendations.

Remote patient monitoring has a similar tendency as telemedicine. The overall financing of the solutions on remote monitoring has increased more than twice — from $417M to $941M during 2020.

Wearable devices will become even more important components of patient observation, providing support and tracking the state of mental health from home. Digital biomarkers (indicators of the body condition: physiological, mental, etc., which are collected using various types of digital devices) have diagnostic potential, which makes it possible to expand the options for using remote patient monitoring (RPM).

The potential of developing RPM tools, including those to cure chronic illnesses, will increase from year to year, which is conditioned by the doctor’s access to the patients’ data, and this will enable them to create disease prevention models.

The pandemic became a trigger of problems with mental health: anxiousness, financial stress and isolation. The need for help has also skyrocketed among healthcare workers due to burnout and PTSD. Hope lies in technology: funding for mental health solutions increased from $599M to $1.4B in 2020, driven by venture capital investments, as well as, public investment, healthcare systems and education.

The largest rounds for the companies that offer mental health protection services were raised by Amwell ($194M), Headspace ($140M), Lyra Health ($110M) and Mindstrong ($100M).

Integrated clinical models are being actively developed and researched to help detect depression and anxiety at early stages, support suicidal patients in emergency departments, and provide scalable, computer-based solutions for cognitive behavioural therapy and counselling.

Social distancing and home isolation measures have increased the demand for home fitness and wellness care. Companies in this sector ranked third in terms of funding in 2020, with total funding of $1.7B. Top-funded deals in this category include Zwift ($450M), ClassPass ($285M), Tonal ($110M) and Strava ($110M).

The significant role in digital healthcare development is allocated to companies that work in R&D (Research and Development — scientific researches and development and engineering works — Startup Jedi). The companies that conducted researches and development of drugs, raised the financing of $2B in 2020 and got up by 5 positions from the point of view of the most funded proposition by Value compared to 2019.

Vividly, the financing of this category has multiply increased due to the pandemic influence: developing the COVID-19 vaccine, the search for new drugs. The TOP-3 largest financed deals in the R&D sector are XtalPi ($319M), ConcertAI($150M) and Insitro ($143M).

...

As the COVID-19 pandemic has shown, patients are striving to harness the value of digital medicine that can offer cutting-edge services: delivering health care to rural and underserved populations, keeping patients in closer contact with their doctors, helping them adhere to their medication schedule and making them better own health risks and medical history.

The prospects of digital health are already open, but the global transformation will only be achieved through the targeted creation of a robust, integrated infrastructure that will bring the benefits of digital medicine to life for the millions of patients who want and need it.

...

Sources: Healthcare Information and Management Systems Society, StartUp Health — health transformer, McKinsey Insights, Mercom Capital Group, Drug discovery trends, MobiHealth News, Digital Health Today, Conversa Health, Tech Crunch.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments