Startup Jedi

We talk to startups and investors, you get the value.

A Belarusian fintech startup Cashew always delivers good news about successes of the country’s IT-entrepreneurs. The participation in a prestigious Barclays Accelerator, big win in the EAEU contest, partnership with the largest bank in Belarus — that’s all about them. Cashew's founder Vladimir Serzhanovich told us about the team that managed to achieve such success and their plans for attracting investments.

Startup Jedi

We talk to startups and investors, you get the value.

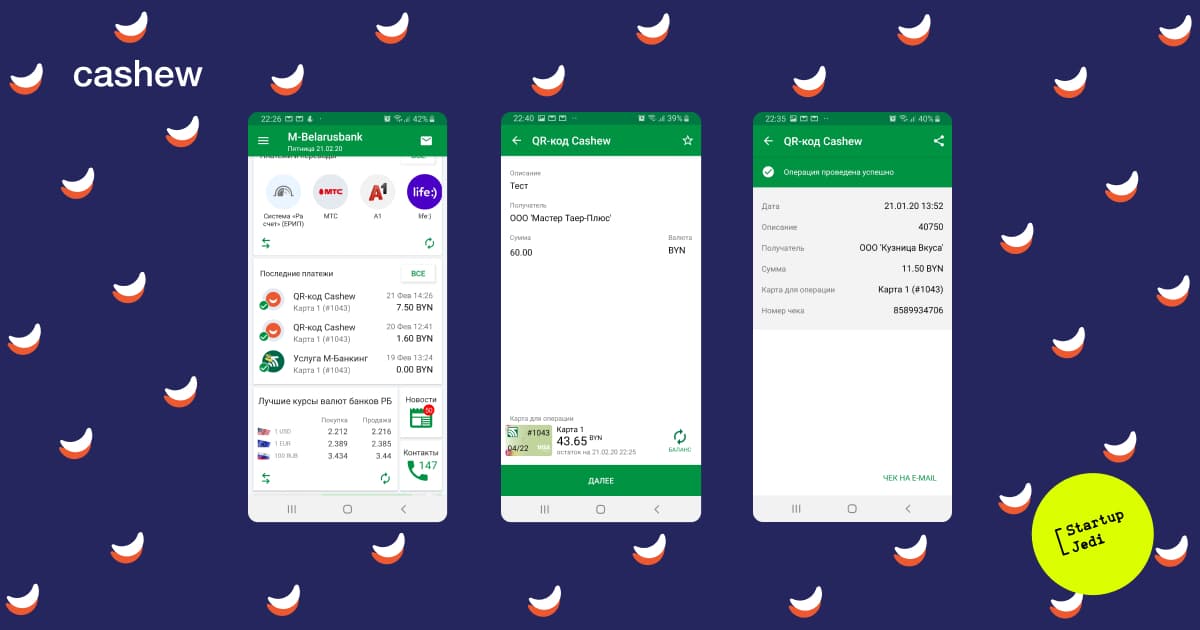

If you have a bank application on your smartphone, it means that you are a potential client of Cashew. We are developing a service that integrates into bank applications and gives the client a possibility to purchase goods by scanning a QR-code or NFS, and to receive personal offers at the point-of-sale. The location of the client is defined by GPS and additional IoT-solutions. When the client opens the banking application, he can see the limited offers, that are available specifically to this very client at this point-of-sales. Cashew will also give a hint of which payment method is the most beneficial.

To sellers, Cashew gives a possibility to receive cashless payments without installing expensive equipment. To open the shop it is enough to register in the system and print out your QR-code. Yeah, the same as WeChat or AliPay in China.

On the contrary to card payments, paying systems (Visa, Mastercard and analogs) are not involved in the payment process. Only the bank processes the payoff. That is why it is possible to save money on a commission of international payment systems and reduce the price for the final customer. And the seller can receive the funds faster. Cashew is perfect for payments in international currencies.

Monetization of the service us based on the subscription model. Sellers and banks will pay for access to the platform, and the price depends on the transaction volume per month.

Now, with the help of Cashew, you can pay in several cafes and shops in Belarus. Among them are “Buslik”, a supermarket for children, and a cafe network “Garage”. The number of partners will constantly grow thanks to the partnership with banks.

By the way, before launching Cashew, our team has launched CopPay, it makes it easier to receive cryptocurrency payments. It works now, but its development is hampered by the very low prevalence of cryptocurrencies as a means of payment and the very high volatility of their exchange rate. Therefore, we switched to working with fiat payments.

...

In order to function, the Cashew platform needs banks-partners. It took about two years to integrate with the first one. Belarusbank became the first partner, the service became available for 3 million of its customers since January 20, 2020.

We found it easier to work with Belarusian banks, rather than with European ones. They are “younger” and less conservative. What is more, European banks are more profitable and this, at some point, reduces their desire for innovations. But the world changes. Being a competitor to fintech companies and IT-giants, banks have to move forward and develop, too.

However, it would take up to two years to realize the identical project with banks from EU or Great Britain that are on par with Belarusbank. In other words, we make light work with it. I want to say words of gratitude to the professional and progressive team of Belarusbank. What they do is important and of big significance to the competitiveness of the Belarusian banking sector.

Now, we are working on the incorporation of our platform in other Belarusian banks. Some people are interested in technology and we are waiting for new partners to join this year.

Besides, in 2020, we also plan to incorporate Cashew in one of the largest British banks. Great Britain is one of our main markets. Thanks to participation in Barclays Accelerators, we have many contacts in banking and fintech sectors there. In the UK, we have opened an office and are actively working with British banks and trade enterprises.

Also, we put our eye on the EAEU market, as the situation there is favorable for our development. The banking sector is developed, people are actively using their bank accounts. Russia and EAEU countries belong to them. Our conclusions are proved by the fact that this year, Bank of Russia and Sberbank started testing a product, similar to ours.

...

We have a strong team of 12 people. Inna Samovich, the CEO of the project, received a financial degree in the US, she managed a network of tire centers Michelin TYREPLUS and got an MBA in the EU. She has experience in communication with clients in Great Britain and Europe. Timur Korneenko, the project’s CTO, the architect and developer, has experience in the creation of fintech products for the National Bank of the Republic of Belarus and retail business in the EU.

Victor Suzdaltsev, the project’s CFO, has many years’ working experience in the bank industry, he is a member of the National Interbank Processing Centre and he’s a coordinating manager on “Blockchain development” in the framework of Digital business confederation by the National Bank of the Republic of Belarus.

We have a well-coordinated team with competences in business, IT, banking. We know how to solve difficult tasks in short terms and easily adapt to changing business environment. What is more, our team has released one project on the European market, it was among TOP 10 European startups in 2018.

We are open to new people in our team, currently we are looking for active people, who are interested in marketing.

...

Barclays Accelerator powered by Techstars is a fintech accelerator that receives more than enough applications. Cashew was chosen out of thousands of projects, and only on the work process, we understood why the competition to join the program was so high.

During the first month of the program, we had so-called Mentor Madness. The accelerator gave us a unique possibility to receive pieces of advice from more than 100 mentors from all around the world. There were bank top-managers, managers from fintech companies, technical specialists, representatives from payment systems. A few mentors became our advisors and we keep actively communicating with them even now.

Thanks to the feedback and pieces of advice from mentors, we completely changed the product and clearly formulated the goal of our project. After this, we were developing the product with an awesome team from the accelerator for 5 weeks. One more month was spent on communication with potential clients and preparation for Demo Day. There gathered leading investors from every industry from all around the world.

The accelerator is a ramp to fly high from the local to the global market. It gave us access to industry leaders. Before, I couldn’t even imagine that we would be able to communicate with Barclays CTO or present our project to the leading organizations from Great Britain. What is more, the accelerator gave us such a boost and self-confidence that I doubt that we will stop until we change the world.

What is more, yesterday we learned that the British Department of International Trade invited Cashew as a representative from the Republic of Belarus to participate in the Global Entrepreneurship Program. This is a government program that aims to support young and innovative companies that have the potential to grow in the UK. Our curator will present our product and team to potential partners who may be interested in the Cashew solution. They will help us organize meetings with investment funds and take part in industry events. This will be a great support for our project to enter the British market.

...

After the acceleration, the project was highly appreciated by investors and gained their loyalty. The startup attracted investments that amount to $120 thousand from Barclays and Techstars accelerator. In addition, we attracted $100 thousand from three Belarusian business angels.

In Techstart we learned that startups have to be in a constant process of investment attraction. Even if there is no need for money now. Currently, we are in the Pre-Seed round, which Techstars, Barclays and business angels have already taken part in. Being valued at $3,7 million, we attract $350 thousand to our British company.

We plan to conclude the deal using Convertible Loan Note. In the nearest time, in addition to attracting investments from business angels and private investors, we also plan to launch on Crowdcube — a British-wide crowdfunding platform, that specializes in investments in fintech startups.

...

I would be happy to share my experience and help all fintech startups, that can answer what kind of problem and whose problem they are solving, in the role of a mentor and a business angel. And the piece of advice is pretty simple, as Churchill said: “Success consists of going from failure to failure without loss of enthusiasm.”

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments