Startup Jedi

We talk to startups and investors, you get the value.

Messengers are a good channel for client attraction. But to buy products in the usual way you will be redirected to the website of a paying system and you will need to pass a few more steps to pay there. Tap2Pay team destroys these obstacles. With its help, you receive payments from the main digital channels in a few clicks. Seamlessly, quickly and cheaply.

Anna Rechnitskaya, Tap2Pay CMO, tells us how the service managed to become a partner of the largest European banks and what investors the team is ready to accept.

Startup Jedi

We talk to startups and investors, you get the value.

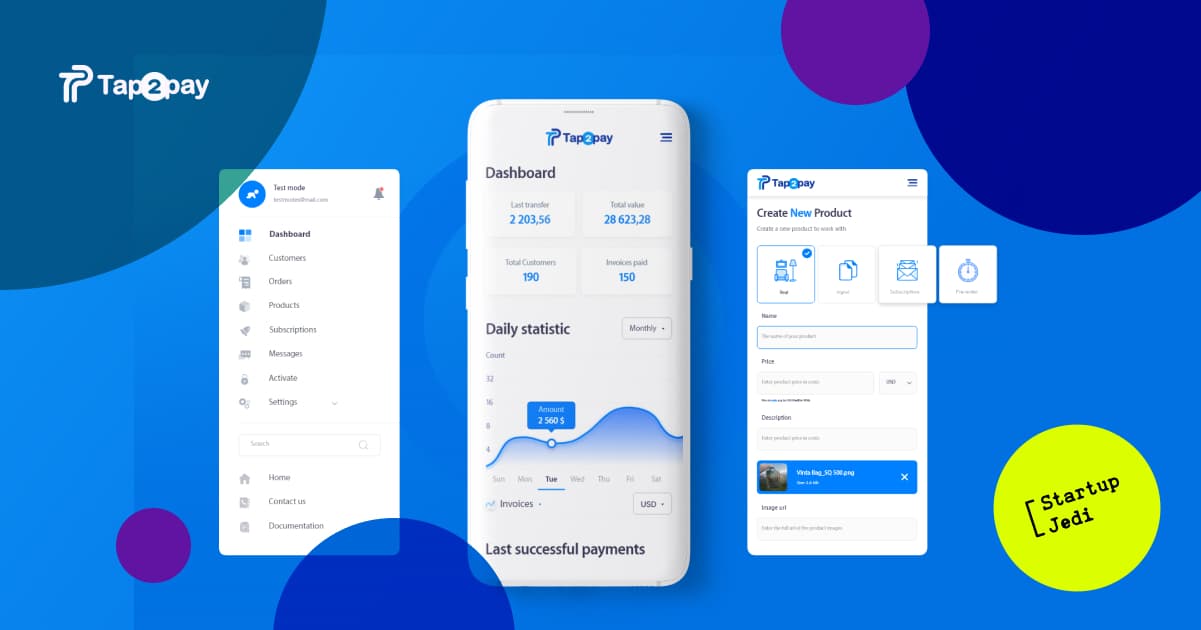

In digital channels, the more difficult the payment process is, the lower the order conversion from an order to a sale. Tap2Pay team offers a solution to receive payments in any digital channel in two clicks. When the seller connects to the service, a client after clicking the “Buy” button, receives the receipt in the messenger. The person just needs to confirm the payment and specify the account to withdraw the money. Two clicks.

The client happens to be in a comfortable messenger, he doesn’t need to redirect himself to any websites. Thanks to this, the conversion increases from an order in a sale. Also, thanks to chat-bots you can organize the whole selling process from the first meeting to the payment in the messenger.

Once you add your card to Tap2Pay, a person gets something similar to the wallet. In the places with offline-sales, it is possible to pay by scanning the QR-code. You don’t need any special devices for receiving payments and you can leave the real wallet at home.

For a seller, a Tap2Pay integration doesn’t take too much time too. The person has to create a seller’s account in the system and add the payment link to the post or advertisement in social media, or add the JavaScrip-code to the website. You don’t need any programming skills to do this.

And this solves the pain of our potential clients, that we defined with the help of our quality research. In the polls we created, sellers said that it was hard to add payment systems to their websites. From the polls, we also know that our target audience actively uses messengers to communicate with customers. We put these two aspects together and got the idea for a startup.

Currently, there are 2500 registered sellers on the Tap2Pay platform. The transaction volume for the last year increased 43 times.

...

Acquiring (processing the payment from the card) is provided by banks-partners. We don’t store the client’s credit card data, all the sensitive information is processed by the bank. In such a way we guarantee the safety of the operations.

The hardest step in product creation appeared to be integrations with paying systems. As soon as we have partnerships with inquiry banks, we have to integrate with their API. And it isn’t always easy.

In general, the finance industry is regulated. All ideas, decisions, agreements require a thorough juridical elaboration and consent. The approval process appears to be very long and expensive.

...

Tap2pay always manages to win in the startup contests. In our piggy bank there are such achievements as the local Belarususian event Belbiz Buttlem, Startup of the year, Emerge Conference, as well as some international contests: our team has won the “Future Finance” hackathon, which was organized by the Finnish OP Bank and Visa’s Everywhere initiative contest. After this, Tap2Pay has accomplished the acceleration in Huge Thing — a large Polish accelerator.

Competitions that we take part in are always very goal-oriented and we choose them thoroughly. We participate if there is an opportunity to cooperate with banks, corporations, and financial organizations.

The unchangeable pitcher of our product is Evgeniy Palchevskiy, the CEO of the project. He is like a parent who knows the product from the top to the bottom and loves it more than anyone else. And this works: people believe in him and in his project.

We always study the audience we will be pitching to and adjust our presentation accordingly. The most important is to set a clear product value for everyone who is going to listen to the presentation. Thus, we do not use standard phrases and statements.

As a result, we received an opportunity to create pilot projects with SIBIS — Portuguese national payment system, Polish Santander Bank, and now, we are cooperating with MCX — Payment Solutions Provider in Poland. We received a grant to develop the pilot project. The same was in the case with Visa: there was a grant offer and opportunities for further cooperation.

Still, we cannot disclose the results of these projects as there is still a lot to be done. Unfortunately, when it comes to working with banks, it may require more time than we expected.

Competitions and cooperation with large companies are perfect channels to attract clients. With the help of such activities, we establish credibility between us and future customers. Besides, we are developing various online sales and promotion methods. More clients come from European countries. However, we don’t need a physical office in those countries to assist them.

Nevertheless, we are discussing the idea of opening a few offices in Europe. We realized that it is much easier to interact with the customers, being physically present near them. When local sales managers are working in places, the conversion in orders is considerably higher.

The service is successfully working in 55 countries including CIS, EU countries and the USA. This year the payment turnover via our service exceeded $1 million. The amount of registered merchants has increased by 68% in 2019.

Recently, we have connected Minsk amusement parks (Park Gorkogo and Park Chelyuskintsev) to our service. Starting from this spring, it will be possible to pay for the arcades with Tap2Pay via QR-code. How will it work? Near the stalls and arcades themselves, there will be banners with QR-codes. You just need to scan it with a smartphone. After that, there will be a widget on the screen where just in a few clicks you would be able to buy a ticket.

When paid, the customer will receive an E-Ticket that should be scanned with a special device, placed near the entrance. It can be done without any contacts with park staff and cashiers.

The Freestyle Waterpark payment system works similarly. After purchasing a ticket on the website with Tap2Pay, the client receives an E-ticket with a QR-code, scans it via a special device that generates bracelets, required to enter the waterpark. Using this payment method, the customer does not need to contact any of the Freestyle staff, everything is automatized and without long queues.

...

Depending on the number of payments and additional services, we either take a certain percent of the paid amount or fixed price for the service subscription. Today the Premium Plan costs $49 and offers the opportunity to use other service functions such as merchants chat-bot integration; branded access to Tap2Pay CRM with all clients’ chats in messenger and more other features. We also offer the opportunity to create a branded chat-bot and a payment widget for larger companies.

This model was initially chosen and remains unchangeable. There is no point to reinvent the wheel as most of the payment systems work under this scheme.

...

Tap2Pay is developing as one of the company’s projects. Previously, we launched products related to web and mobile analytics and website monitoring. With the help of existing resources, we managed to launch the product successfully from the start and right after the start, the startup began to connect the customers. Later, the company won Visa grant in terms of Everywhere Initiative competition.

The combination of service profit, financial support from our main project and grant allowed us to create a working product without attracting any investments.

As for now, we are not in active search of investors but always ready to consider interesting proposals from the experts, experienced in e-commerce and fintech fields, preferably from EU countries or the USA.

We have a motto: “Clients are the best investors”. They are the people who already understood the product’s value and are interested in its development. Currently, we are moving towards this direction.

...

Our main goal for the next year is to increase the number of clients, meaning the companies, that accept payments via Tap2Pay. We are going to open the European sales office to achieve this.

We have a small but very bonded team, consisting of 5 members. One of them is working remotely from Moscow, all others — from Minsk. It is planned to empower the team with experienced sales managers. We are looking for a Ruby-developer as well.

...

All the fintech-projects founders we can advise to build strong and credible relations with partners and payment systems right from the start. In this field, a lot of things are built upon those interpersonal connections.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments