Startup Jedi

We talk to startups and investors, you get the value.

With this article we’re wrapping up our “Technology of the Future” cycle, where we have covered the impact of the COVID-2019 pandemic on various areas of business and life. FoodTech is no exception. To find out what changes have occurred in the industry, we took a look at The Dealroom report, which they released together with FiveSeasons Ventures on March 25, 2021. In this article, we’ll be talking about the main startups and deals in this industry, and, of course, drawing some conclusions.

Startup Jedi

We talk to startups and investors, you get the value.

FoodTech is an ecosystem of products and services from production to distribution of food products.

Over the past year, three main trends have emerged in the FoodTech industry:

Users in 2020 rethought their approach to nutrition and changed their eating habits in many ways;

COVID-19 has accelerated e-commerce in food and boosted the emergence of new models of product distribution;

Food production and processing, as the most conservative areas, reflected the trends that appeared in the FoodTech industry in general, where, first, the industry was shifting to a more customer-oriented approach.

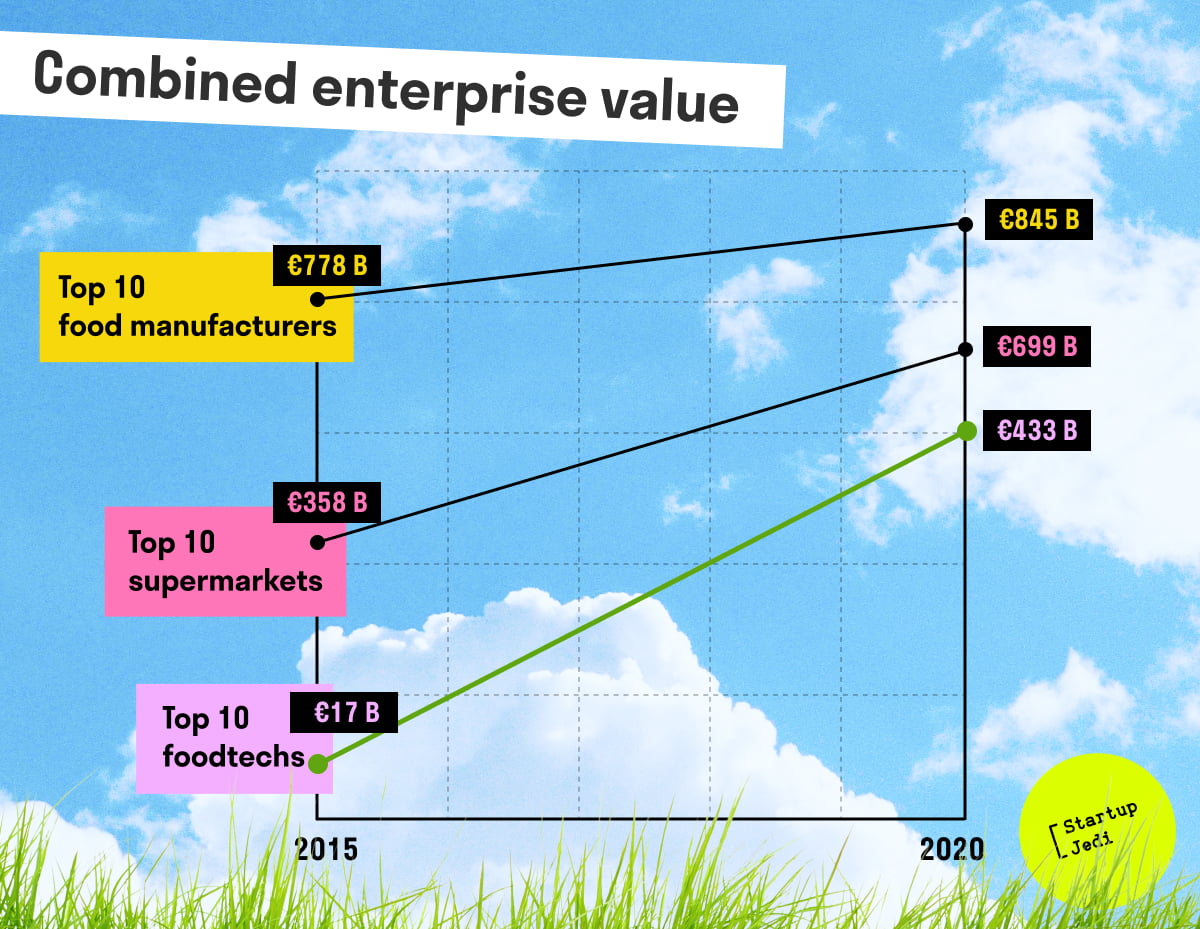

But let’s talk numbers, and first of all, compare the dynamics of development in 2020 for food manufacturers, supermarkets and projects in the FoodTech sector. All three areas have grown over the past year. Here are the numbers in the report for the top 10 companies in each industry from 2015 to 2020:

Producers of products: growth from €778B to €845B — almost 110%.

Supermarkets: growth from €358B to €699B — or 195%.

FoodTech projects: growth from €17B to €433B — that is, by 2547%.

With these staggering numbers, the report says FoodTech has yet to fully realize its potential.

...

European “unicorns” in FoodTech have reached a total capitalization of €92B. Among them are both public companies and those that are still off the exchange.

Zooplus is a German online store of pet food and products. Founded in 1999, it operates in 30 countries in Europe and the UK.

Delivery Hero is an international food delivery service. The company operates in more than 40 countries around the world in Europe, Asia, Latin America and the Middle East and works with more than 500 000 restaurants.

HelloFresh is a startup that sells meal kits. After ordering one, you will receive a box with pre-portioned ingredients and an easy-to-follow recipe. According to their website, “A fun cooking experience that makes you feel unstoppable.”

At the same time, things are not all rosy on the European market. Investments in FoodTech in 2020 fell by 11% to €2.4B compared to last year — although this is 13 times more than the size of investments in this area in 2013.

But it would be strange to consider the European market in isolation from the US and Asian markets. Well, Europeans could have shown the best growth in the world if not for the phenomenal growth of the Meituan Dianping project.

Meituan Dianping is a Chinese online food and goods delivery company with millions of buyers and sellers. Its capitalization reached €204B out of the total of €274B capitalization of all Asian “unicorns”. And this company pulled the entire Asian market to first place with a growth rate of 197% over the previous year. It’s followed by Europe with capitalization growth of 156%, while American FoodTech unicorns showed a “modest” growth of 101% compared to 2019. At the same time, the capitalization of European “unicorns” itself is 2 times lower than in America and 3 times lower than in Asia.

...

What other areas are developing in the food sector? Dark kitchen projects also known as host kitchens are delivery-only units that keep growing and seek their ideal business model. They can be divided into three areas:

A “virtual restaurant” is one or more online restaurants where you can order food for yourself: for example, Tasterwhere you can order the best street food from various online units, or Keatz — a chain of restaurants that delivers modern cuisine.

“Coworking” for chefs — these startups build kitchens to rent out to chefs or delivery restaurants: for example, CloudKitchens project.

“Virtual franchises” — projects that offer franchises to create a “virtual restaurant”, like KboxGlobal or Virtual Dining Concepts.

COVID-19 has brought the d2c segment back to life(Direct-to-consumer — selling products directly to buyers without intermediaries in the form of private sellers, supermarkets and others. — Startup Jedi). D2c appeared in the 90s, when manufacturers were just starting out in online trading. Then a certain recession followed, caused by the growth of interest in trading platforms, and 2020 boosted its development again and the segment reached an estimate of €84B. There are several directions within d2c:

snacks (like Vinebox — a service that sends the user three glasses of wine per month using the subscription model);

breakfasts, lunch and dinner sets (like HelloFresh that we discussed above);

pet food (PetPlate — delivery of personalised meals for your pet);

tea and coffee (Wakuli — fresh farmer’s coffee delivery);

protein nutrition (for example, a sensational plant-based meat start-up BeyondMeat).

All projects mentioned above have to do with distribution and consumption, where processes and habits can change quite quickly. It is worth remembering that this is the last stage in a rather long chain, which starts with production, goes through processing and only then comes to consumption. But the pandemic has taken a much more serious toll on projects working in production and processing of food products, since changing them as quickly as distribution is difficult to say the least. Most of the investments in these areas were raised by projects that offered to automate and robotize processes. (we covered this in our article “Technology of the future: Robotics”). Such startups raised a 5-year record of €1B.

...

Finally, let’s discuss what investors are most interested in — exits. Here are the top three purchases:

goPuff is a delivery startup operating in more than 650 US cities that acquired a chain of alcoholic beverages BevMo! for €293M with a multiplier of 8.2x.

European food delivery service Just Eat Takeaway.com bought American food delivery service Grubhub for €7.3B, but with a multiplier of 5.7x. The unified network now has 70M users worldwide.

Uber bought young food delivery company Postmates for €2.6B at a multiple of 5.3x.

And finally, let’s take a look at the list of FoodTech investments for 2020:

The largest deal cited by Dealroom in its report was €55M invested in laboratory meat producer Mosa Meat from BELL Food Group in September 2020, raised as part of Round B.

With €22M the 2nd place goes to The Protein Brewery, a Dutch non-animal protein producer that received this amount in Round A from Roquette.

And our personal favorite closes the top three (because what could be better than wine!) — % a startup Vitibot, automating wine production and raised €11M in early October 2020 from Pernod Ricard.

It is worth noting that among European investors in FoodTech, the French were the most active with Five Seasons Ventures leading the chart. They are followed by Demeter, Kima Ventures, Pymwymic, Astanor Ventures, Founders Future, Idinvest Partners, Balderton Capital and Indico Capital Partners.

FoodTech is an industry that will always be trendy, and only time will tell in what direction its services will develop and what products we will use in the future.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments