Startup Jedi

We talk to startups and investors, you get the value.

Startup Jedi

We talk to startups and investors, you get the value.

If you are interested in investments, then you’re probably familiar with FAANG abbreviation, which is made up of the first letters of the names of five large world-famous IT companies from the US. So, what are the companies that conclude FAANG? Here’s the answer: Facebook, Amazon, Apple, Netflix и Google (Alphabet). In this article, we will give some more details on FAANG, shares characteristics and companies, as well as, how to invest in FAANG shares.

The creator of the “FAANG” term is Jim Kramer, a telehost of the MadMoney TV program at CNBC. In 2013, he named three criteria which one have to take into account while choosing shares to invest:

The company has to be connected with future trends.

The company has to dominate on the market.

Shares have to show growth.

FAANG are the shares of the five most important tech-companies. These shares are some of the most frequently traded on exchanges and have one of the largest market capitalizations in the world. As of August 2020, the aggregate capitalization of the FAANG group companies amounted to $5.6T, and at the time of this article, it was already $7.1T.

FAANG shares catch investors’ attention due to a number of reasons. The main are:

these shares belong to mature IT companies and market leaders in corresponding segments;

companies that are part of the FAANG group have huge growth potential;

the FAANG five takes leading positions in S&P 500 index.

Thus, we answer the question, what is faang: these are the five largest IT companies in the US high-tech sector, which can be considered the standard of doing business and success. All of these companies are at the top of the S&P 500 index and continue to show high growth potential. Companies provide Internet services, we can assume that they are the very brands without which it is difficult to imagine the life of the average American.

FAANG shares are considered one of the most reliable and stable, so they are more often used for long-term investments. The possibility that FAANG shares will collapse is quite low. The option of short-term investments is also possible: when the stock market is unstable and some FAANG companies are influenced by fundamental factors, such as profit and loss statements, news, so at this time, the prices of the shares may fluctuate significantly.

At the same time, new leaders can come instead of FAANG and market trends can change. Besides, FAANG companies belong to the tech sector, so while investing only in them, you can lose profit on the growth of other fields.

FAANG shares are quoted in S&P 500, NASDAQ 100, NYCE FANG Index indexes.

Considering S&P 500, FAANG companies acquire more than 16% of the index, and it is quite a lot, taking into account that the full list includes 500 companies. But if we talk about the NASDAQ index, then the shares of all five FAANG companies is about a third of all shares of the index.

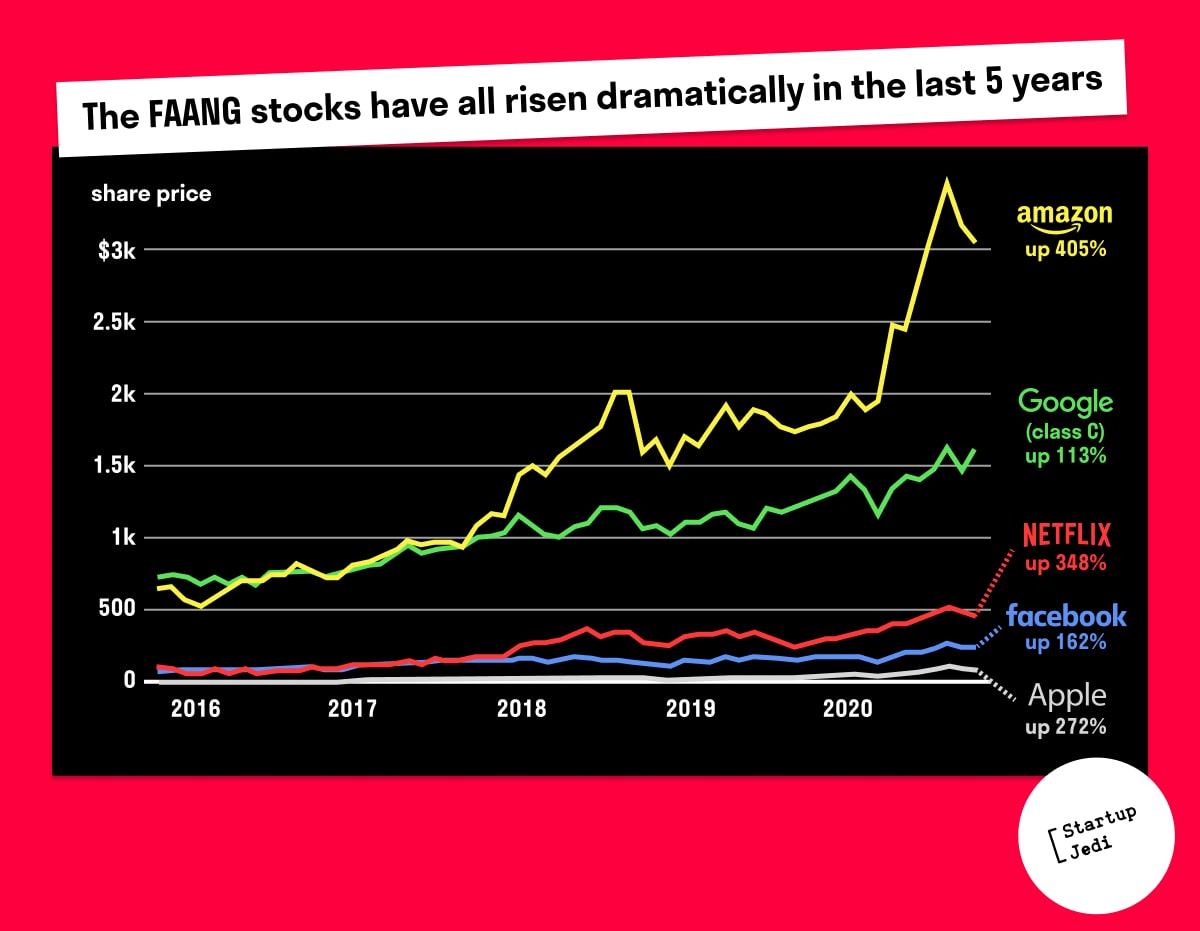

FAANG shares have risen distinctly over the past 5 years, the dynamics of their growth significantly outstripping the dynamics of the market in general. Stock fluctuations often foreshadow general trends in the American economy. For example, right after the news of the global Facebook crash, the S&P Index fell by 1.3%, the Nasdaq 100 by more than 2%, the Dow Jones by 1% and the NYSE Composite fell by 0.73%.

It is considered that all of these companies benefit from the so-called "network effect": their products and services become more expensive as more people use them. Google, Facebook are valuable because of billions of active users, Amazon because of millions of active buyers. As for Apple and Netflix, the same effect works for them too: Netflix has tens of millions of viewers, Apple has users.

There are a few ways to invest into FAANG shares:

Purchase shares of each of the FAANG companies on the stock exchanges separately. All of these stocks are listed on the NASDAQ. For example, in Russia, FAANG shares can be bought on the St. Petersburg Stock Exchange. You can buy shares of all five companies and build your own portfolio. How much will it cost? If you buy one share of each of the companies, it will cost about $7200, but if you buy shares in the same proportion (20% per each company), you need about $16500.

It is possible to invest in FAANG shares through ETF funds (stock exchange funds), as any fund that has specialization in IT, includes these shares. Look for funds that invest not less than 80% of their active assets in FAANG. Top of the ETF list: iShares Expanded Tech Sector ETF (IGM), NYSE Technology ETF (XNTK) и Invesco QQQ Trust (QQQ).

Through Index Funds, which are a type of Exchange Traded Fund (ETF) that follows an index investment strategy. By purchasing one share of an index fund, you are buying shares in dozens of companies.

FAANG abbreviation consists of the letters which stand for the names of the largest companies of the American and world IT sector. Let’s have a closer look at these companies.

Facebook is the company that owns the two largest social networks in the world — Facebook and Instagram, as well as the two largest messaging apps — WhatsApp and Messenger. Facebook receives part of the revenue through advertising, and the company's revenue over the past 10 years has increased more than 50 times: from $1.97B in 2010 to $90B in 2020. One of the reasons for such growth is the flexibility of the company, which changes in accordance with the user needs.

Facebook's projected revenue growth is around 20%, which is very promising. Facebook also has one of the most stable cash flows in comparison to other FAANG shares, which means the company is less affected by economic uncertainty than others.

At the time of this writing, Facebook's market capitalization was $930B, and Facebook's share price was around $330.

Apple is one of the largest manufacturers of the like-named brand of consumer electronics (smartphones, tablets, various gadgets) in the world and software for them. In addition, Apple, with its iCloud product, is one of the leaders in cloud computing and online storage.

The company's capitalization at the time of this writing was $2.36T and the price of one share was $142.9.

Amazon is the largest player in e-commerce and it also specializes in streaming (Amazon Prime Video), distribution and logistics. Over the past 10 years, the revenue of this American company has grown from $34.2B to more than $260B, which means that Amazon's revenue is growing by 25% annually. Amazon has one of the highest P/E(price/earnings) ratios for IT stocks, indicating that Amazon will continue to grow.

Amazon's capitalization at the time of the release of the article was $1.67T and one Amazon share was worth $3288.62.

Netflix is probably the most popular streaming service in its sector, and it has also been producing its own content since 2012. Over the past decade, the company has grown by 10 times. The company is growing at about 22% per year and has a strong P/E ratio. Netflix has been the S&P leader for the past 10 years and has generated a 3,693% return on its investor holders.

The company's capitalization is $280B and the price of one share on the stock exchange is $632.66.

Google (now Alphabet) is an American transnational IT corporation specializing in Internet search, cloud technologies industry, and the development of Internet services. Google owns the largest search engine in the world, accounting for about 92% of all online searches in recent years. Alphabet, the parent company of Google, owns companies in various sectors: it owns YouTube, the largest video hosting service for storing, sharing, showing videos, the venture capital fund GV (formerly Google Ventures).

The company's capitalization is $1.86T and the share price is $2795.

It is worth adding that initially the abbreviation sounded like FANG and Facebook was followed by Amazon, but a bit later in 2017, Apple was also included in the group.

So, FAANG stands for the five largest American companies, which are highly demanded on stock exchanges and are attractive to investors from all over the world. These companies are: Facebook, Apple, Amazon, Netflix, Google. FAANG shares are more often used for long-term investments, but they can also be used for short-term investments: when there are rates fluctuations. There are several ways to buy FAANG shares: through the purchase of individual shares on stock exchanges, through the purchasing of ETF shares of funds, who already have FAANG shares in their portfolio, or through index funds.

If you’re interested in investing and similar topics, we recommend you to read this article “Where to invest in 2021: optimal investment”.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments