Startup Jedi

We talk to startups and investors, you get the value.

The venture capital world may seem very complex, inexplicit, to a certain extent closed and too difficult to understand for a person who has never worked in this sphere before. Who should you turn to for financing, what amount of money should you ask for, how and under which conditions should you negotiate on an investment deal? Where should you look for the recognized specialists who could help you by giving advice based on their own experience, introducing to potential customers or mentors, guiding your startup on the way to exponential growth and to entering new prospect markets? Let us clarify all these points.

Startup Jedi

We talk to startups and investors, you get the value.

Key players on the startup support market are business angels and venture funds. Usually, these two are equalized by making a reservation that angels are more likely to enter the project on earlier and riskier development stages. I really wish it all would be that easy!

...

If Angels invest their own funds in the projects only, Venture funds attract and accumulate funds of institutional investors (pension funds, insurance companies, family funds, high net worth individuals). Consequently, an average Venture fund has ten times more capital under management than an average business angel. And since both of them form their portfolios of the invested initiatives, the average investment check differs approximately in the same proportion (as the amount of total funds). Angels are ready to invest in one project from $5k to $100k (exceptions are transactions when several business angels enter the project at a time, then the total round can reach up to $1m). At the same time, Venture funds generally do not invest less than $500 thousand in one project.

Business angels: $5–100k

Venture funds: from $500k

...

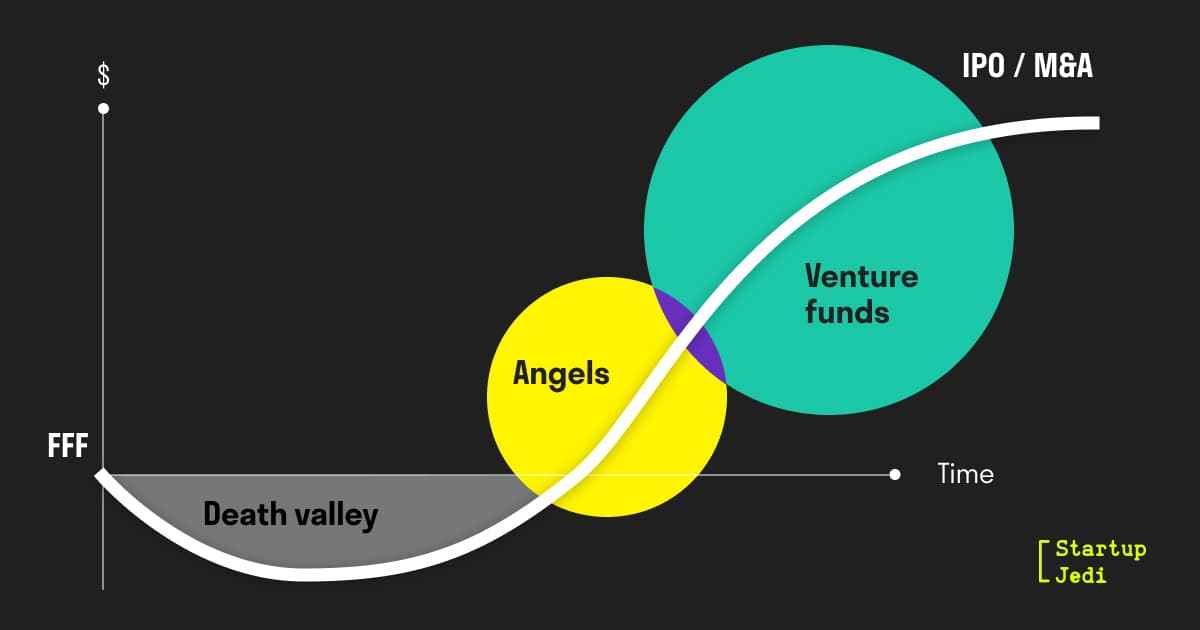

Accordingly, angels enter the projects earlier, usually before there is an MVP or a prototype even. They are ready to accept high risks directly connected with the realization and development of such projects. In return, angels receive a share in the company. At the same time Funds prefer to invest in projects with at least minimal traction (dynamics of financial indicators), although there are exceptions sure, these might be connected with the experience of the founders, for example, if they have already made a successful project and earned their reputation in the market, their chances to attract investment on the earlier stages are much higher (for example, startup Coda attracted $ 60 m more than a year prior the release of the beta version of the product).

Business angels: Pre-Seed/ Seed

Venture funds: Seed/ Series A, B and so forth

...

It is evident that angels entering the projects in early stages have to work with the teams closely as they become their first mentors. That’s why they prefer to invest in the local projects (they say sometimes that angels support startup which a located in a one-hour drive distance). Funds usually do not follow this rule.

Business angels: nearest regions

Venture funds: not bound to specific regions

...

An average angel deal closes in a few weeks — maximum in a month. Venture funds, on the other hand, have a much more formal decision-making system; projects must not only be evaluated by fund analysts, but also approved by the investment committee, undergo internal due diligence, and an independent financial and legal audit. In addition, transactions with funds have a much more complex legal structure. All this leads to the fact that the average time of closing the round from the fund varies from 3 to 6 months.

Business angels: up to 1 month

Venture funds: from 3 to 6 months

...

As rule, angels receive ordinary shares when investing in startups, what equals their rights with the project’s founders. Funds usually take preferred shares (with additional rights and liquidation privileges), as well as a place in the company’s board of directors and the right of veto on some of the most sensitive moments (for example, alienation of intellectual property, loans, substantial spendings, etc.).

Business angels: ordinary shares

Venture funds: preferred shares

...

In recent years, the venture capital market has been literally flooded with money, so today good projects may even choose a source of capital which they prefer most, depending on their own interests. In such cases, a new value may play a significant role in choosing an investor — smart money.

Usually, business angels invest in projects from the industries which they have certain expertise in, so the main value they can give is to help in creating a product, attracting first customers and hiring first employees. Venture funds provide startups with more structural support. Most of them have well-established portfolio management systems for all technical and administrative issues not related to product development and entering new markets, — such as hiring personnel, accounting, legal, financial issues, etc.

Business angels: industry / niche expertise, early-stage startups support

Venture funds: structural support in technical and administrative issues

...

Since the Funds manage accumulated funds (not their own), they do their best to minimize all possible risks, what results in a much longer process of closing the deals and in much more strict requirements to the report that the portfolio companies are to prepare on a regular basis (either quarterly or monthly). On the contrary, Business angels usually build their communications on a more informal, conceptual framework.

Business angels: informal communications

Venture funds: regular reports

...

Angel investments are easier to attract, they are faster, more flexible, but their amount is pretty limited, moreover, they give value to the early-staged projects.

Venture capital funds are slower, more thorough, investing procedures and regular reporting from the portfolio startups are explicitly structured. At the same time, funds can help to “pack” a company administratively, as well as to introduce a startup to a wider network of partners and investors.

These two types of investors hardly ever compete for the projects (as an exception from this rule one can mention the deals with projects at early seed stages with $ 300–500k investments, which Business angel syndicates and early-stage Venture funds can really compete for).

Hence projects typically do not choose who go for the investments to: to business angels or to venture funds. This choice is predetermined by the project’s development stage.

If your project isn’t present on the market yet, then in 99% of all cases you should negotiate on investments with business angels first.

As soon as you have some traction and scalability strategy you may confidently address to venture funds.

However, there is an alternative way you should also bear in mind. I am talking about accelerators. In the next articlem I will clarify the way they work and the value they can give to the projects.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments