Startup Jedi

We talk to startups and investors, you get the value.

India is not the easiest country to scale up or relocate a business. It would be complicated to do without a local partner, even if the law allowed it. Without a “own” person from inside you will be long acquainted with the specificity of the market and will not fully understand it even in a year. And you have to speak to your clients in one language, both physiologically and mentally. In “India A” all speak English, but if you focus only on them, you limit your market to 50 million people.

Startup Jedi

We talk to startups and investors, you get the value.

Arman Suleimenov, CEO and founder of Zero To One Labs and nFactorial Incubator, lived in India for two years, doing FinTech projects. He faced the peculiarities of Indian business culture and mentality, and honestly told Startup Jedi about it. Including what’s not in the auditors' reports.

In a previous article about India, Arman talked about what the Indian economy is, how the Indian "IT miracle" appeared and what you need to know about the country's startup infrastructure.

Think carefully about whether you need it. Due to the fact that employees of Indian state institutions have low salaries, an unwritten rule works almost everywhere: you need to give a bribe. It doesn't matter what question you solve — you get a simple certificate or buy a house. You will simply be "kicked" from one place to another for no obvious reason, until you understand what is going on. At the same time, no one will say directly about the bribe — it is assumed that you know this.

Deadlines are often violated, and this is not considered something shameful here. As if, when agreeing on the 10th, all the parties understood that in fact we are talking about the 20th.

Because of the huge difference in mentality and business thinking, you can't just take your successful project, come to India and repeat it there. And it's not about diligence: a business model that worked in Belarus, China or the United States simply won't work in India. At least, it will have to be adjusted, but rather redone. But the big plus of the emerging and growing market is that it is flexible and not ossified. Consumer habits are formed, you can offer your own options and find compromises.

It is hard for a foreign startup to get significant state support in India. The current government pursues a protectionist policy, it lobbies for the interests of local businesses and protects its jobs.

But if you are determined, the information on these links will be useful to you.

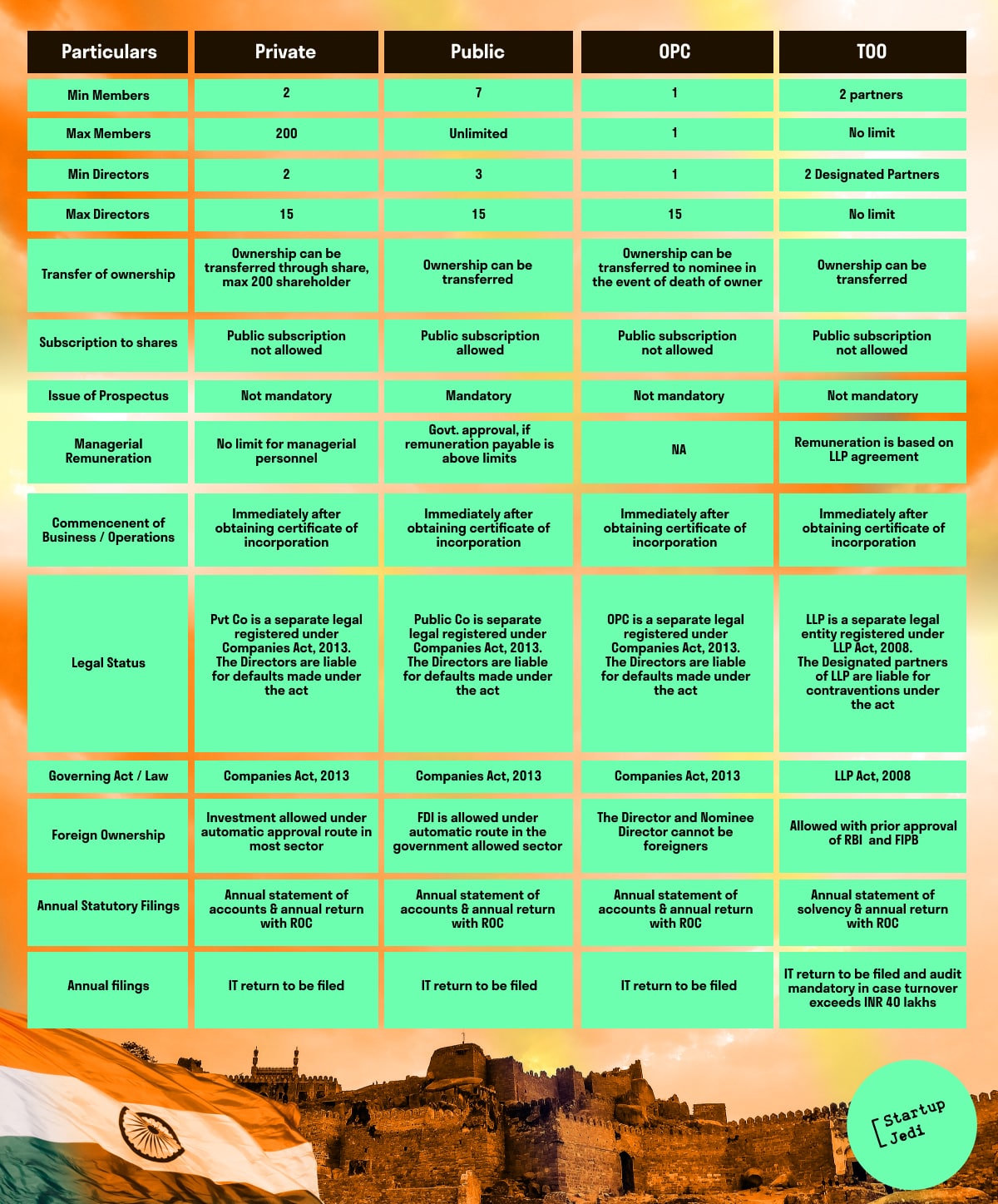

1. Here you can find useful information on the incorporation of a company in India. It's all about what legal form to choose for registration, what requirements are imposed on applicants, what exactly to do for the registration of a company.

2. Overview of the advantages of each of the five legal forms suitable for registering a startup.

3. This test will show how well you understand the laws governing the work of startups in India.

4. The largest Indian incubator, also actively investing in startups at the Seed stage, Venture Catalysts. He has already had 35 successful exits, the total value of portfolio companies exceeds $1 billion.

5. Tax-exempt opportunities for startups.

6. What are the options for visas to India, and what is needed to obtain them.

...

After two hundred years of colonization, Britain left India with three major phenomena: language, the legal system, and the railroad. The advanced instruments of English law give India a great advantage throughout the region. They did not work immediately, but in the last 10 years the authorities have paid great attention to the attractiveness of the country’s business climate. Whereas in the past startups were often registered in Singapore to attract foreign investment, this is no longer necessary.

For several years in India there was a “angel tax”, when 30% of the difference between the startup estimates given by investors and the state was taken into the budget of the country. Because of this, investors grossly underestimated the score, which in the end was bad for all parties. Although this absurd, seemingly absurd, law was an attempt to stop money laundering through small day-to-day companies. Now there is no need to understate the cost of a startup investment, but the bureaucratic spirit has not completely disappeared: all parties will have to go through the paperwork to confirm the real, not fictitious nature of the deal.

But do not despair: there are many foreigners, both funds and angels, in the lists of investors of "unicorns" and just strong startups. This is the best proof that there are conditions for capital inflows, and they are attractive.

1. The catalog of startups registered on the Startup India portal, there are more than 153 thousand in total.

2. The largest Indian business angel network is the Indian Angel Network.

3. The list is of Indian accelerators, not foreign representative offices.

4. Overview of the tax system of India.

5. Guide to entering the Indian market. It will be useful to better understand the business environment.

1. Understand the specifics of the local market

Keep in mind the sector “Three Indies”, and that they constantly change towards qualitative growth. Yet the Indian market is not yet billionaire. If you summarize it, you can call it 100 million. The size of the market and the solvency of its participants influence the estimation of the startup and its maximum value at exit.

2. Be more down-to-earth

In India, unlike in the USA, there are still many “low-growth fruits” not collected. Therefore here you will not find successful start-ups like “insurance for pets” and other solutions to “first world problems”. Requests from Indian society now focus on basic needs. It will be useful to live in India yourself before investing so that you can better experience it and learn to assess the relevance of the problems that startups solve.

There is often a gap between the quality of public and private services. You will want to leave the state hospital as soon as possible, but private medicine is at a high level here. Medical tourism is developed in the country — they fly from Australia, America, and Europe to be treated. The same is true for the entire infrastructure, especially on the periphery. Photos of people riding on the running boards and roofs of transport perfectly reflect reality: in many cities there is an acute shortage of buses. All such problems are the ground for the growth of private business.

And he appears. The Shuttle company, a kind of Uber-bus, offered comfortable trips with a guaranteed seat. This is more expensive than a regular crowded bus, but cheaper than a taxi, even divided into several passengers. Everyone wins: the state — in the fact that they take away the "headache", people — in a convenient service. There are still many such problems, which have long been irrelevant for us, in India.

3. Look at the growth dynamics of a startup

Not only where the startup is now, but also at what pace it grew before, what its growth forecast is, and what it is based on. This is especially important because the Indian market is much less predictable than, say, the American one. Here you need to rely more on numbers than on a "chuyka". At the same time, keep in mind that the market is developing rapidly, and what seems like an average project to you today may turn into a unicorn tomorrow.

4. Talk to those who have already invested in Indian startups in advance

Successful projects, as a rule, tell about their investors. Find them on the Angels List and chat. This can save a lot of your time and warn you against mistakes. Such an appeal for advice is quite normal, not shameful, and adequate people will be happy to share their experience with you.

5. If you have big plans, consider that Indian companies are not listed on NASDAQ

To enter an IPO on NASDAQ, an Indian company needs to register in Singapore or the United States. This also works in the opposite direction: on the national Indian stock exchange NSE, shares of foreign companies are traded poorly — there is still little demand. But even now, two Indian exchanges, NSE and Bombay, are among the top 10 world exchanges.

...

India’s venture capital and overall business world is unpredictable, wild, alive, and full of opportunities. Remember the atmosphere of the seasonal market on a summer day: life is raging, hundreds of sellers and buyers, choice, bargaining, emotions, smells, bright colors. In India, the same is happening now in the field of startups. Yes, there’s still a lot of “raw” and unregulated, but everything goes up like a dandelion from under the asphalt — and there’s no stopping it.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments