Startup Jedi

We talk to startups and investors, you get the value.

Just like with many other countries in Central and Eastern Europe, Polish venture capital relies heavily on government funding. 81% of venture capital rounds over the past decade were supported by the government. But today the venture capital market has made a significant leap: new Polish venture capital firms are opening up that raise significant funds without government assistance. Over the past 3 years there has been an increase in the number of startups, that raised rounds of investments from pan-European and global venture capital firms such as Index Ventures, 3TS, SpeedInvest, and Piton Capital.

Startup Jedi

We talk to startups and investors, you get the value.

The second part of the START IN POLAND series is devoted to the Polish venture capital and the possibilities of raising both state (grants, national programs, funds) and private investments.

You can learn about what Poland is interesting for startups and investors, about the standard of living and the peculiarities of doing business in this country from the first article of this series.

Poland ranks 26th in the global Venture Capital and Private Equity Attractiveness Index. The share of capital raised from Polish public funds and the European Investment Fund is 52% of the total venture capital market — approximately € 1,352 million, followed by private Polish investors with around € 1,040 million. Not Polish LPs (Limited Partners) invested only about € 130 million, while the fund managers themselves usually contribute 4% of the fund size.

According to the study, government programs that support the development of startups are one of the key drivers of investment strategies. This investment vehicle has helped startups mitigate the risk associated with early-stage deals.

From 2017 to Q1 2019 National Research and Development Center (NCBR, Narodowe Centrum Badań i Rozwoju) signed 179 contracts with 29 investment firms using public funds in the amount of € 67 million. Starting from August 2, 2019, the maximum co-financing of one project was up to € 200,000. Until 2018 approximately 81% of venture capital rounds had government capital.

Domestic funds based on money from government programs (PFR Starter, NCBR Bridge Alfa, PFR NCBR CVC and others) remain the greatest strength of the Polish ecosystem.

Venture capital companies / funds in Poland can be divided into the following categories:

1. Public private partnership:

The first quarter of 2021 recorded an increase in the number of transactions with a similar amount of capital invested by more than 40% compared to the first quarter of 2020, according to the Transakcje na polskim rynku VC w Q2 2021 study.

The tendency to expand cooperation between local Polish funds and foreign partners continues. In the first quarter of 2021, 21% of the capital was secured by joint investments of Polish and international funds. In the second quarter of 2021, PLN 936 million passed through the Polish venture capital market. This is the total value of the capital that Polish and foreign funds have invested in domestic innovative companies. This also means that in the first half of 2021, Polish startups received PLN 1.17 billion from investors, which is more than 55% of the value of investments during 2020. This growth trend makes building long-term international relations that improve the quality of smart money provided to Polish startups very promising.

The Polish ecosystem has great potential due to its highly qualified pool of developers and start-up centers operating with private and public venture funding. Experts argue that a greater influx of international venture capital funding into the region should be expected.

National Center for Research and Development (NCBR)

As mentioned above, the Polish venture capital market is growing mainly due to government policy and money aimed at creating and developing the capacity of venture capital funds to operate independently and efficiently in the long term. Public funding is proving to be an important asset in terms of capital availability and managerial skills development.

TDJ Pitango Ventures, created by the National Research and Development Center in 2016 is an excellent example of this. The fund's total capitalization is € 50 million, half of which comes from NCBR. To date, the fund has invested € 10.6 million in 5 companies.

NCBR, which is paving the way and implementing new R&D funding schemes, launched its PFR NCBR CVC corporate venture fund in 2017 with a total value of € 500 million. Thus introducing the CVC (Corporate Venture Capital) scheme for the first time in Poland, which enriches the innovation support ecosystem. PFR NCBR CVC is a closed non-government asset investment fund with an estimated private equity in portfolio funds of at least 50%. The other half comes from NCBR.

In 2018, the first two corporate venture funds were launched, the management organizations of which operate independently. These are EEC Magenta with its corporate investor Tauron Polska Energia S.A. whose total capitalization is € 40 million, and SpeedUp Energy innovation fund with its corporate investor PGE Ventures and total capitalization of € 25 million.

The size of the Polish venture capital market is expected to keep dynamically growing, and so is the amount and value of investments. According to Dealroom, in 2018 venture capital investments in European startups reached € 24.9 billion. At the same time, deals of investors from Silicon Valley and the volume of invested capital are growing in Europe. In 2018, at least one Silicon Valley venture capital firm was involved in 7% of venture deals with European startups (up from 3% in 2013).

Polish Development Fund Group

Polish Development Fund Grupa Polskiego Funduszu Rozwoju is a group of financial and advisory institutions for entrepreneurs, local governments and individuals investing in sustainable socio-economic development of the country.

PFR Ventures is a fund of funds manager that, together with private investors, business angels and corporations, invests in venture capital funds. The aim is to use these funds to support innovative Polish enterprises at an early stage of their development. PFR Ventures currently has over 50 funds in its portfolio, with a total of 250 investments.

Black Pearls (Gdansk) is a venture capital fund based in Gdansk specializing in innovative projects that improve the quality of life in the space industry, agriculture and food production, working closely with academic institutions and building relationships between science and business.

Fidiasz EVC (Wroclaw) is a Seed / Round A fund specializing in fintech, Internet of things, food processing and agricultural technology. The fund is focused on investing in projects and companies that have the potential to scale in Europe.

Giza Polish Ventures (Warsaw) is a venture capital fund backed by one of the best venture capital groups Giza Venture Capital. They invest in companies at all stages, from idea to scaling. Focus: IT, telecommunications, e-commerce, environmental technology, biotechnology, medical equipment.

IdeaBox Capital (Warsaw) is a private investment company investing up to € 14 million in one project. It is part of one of the strongest financial groups in Poland — Idea Bank.

Innovation Nest (Krakow) is one of the most active investors on the venture capital map in Poland. Innovation Nest helps startups on their way to Silicon Valley. They focus on Seed / Round A startups with global plans and invest from $ 25,000 to $ 1 million in them.

INNOventure (Krakow) helps scientists, inventors and entrepreneurs develop business projects based on the results of research and development.

Inovo VC (Warsaw) is a fund participating in Series A rounds or later, with a focus on SaaS companies and marketplaces.

KPT Seed Fund (Krakow) is a joint venture between Krakow Technology Park and Venture Capital Group. There are more than 20 companies in its portfolio. Since 2015, it has been raising capital from its own resources received from the sale of shares of companies that it previously invested in. The special areas of interest of the Fund are early stages of projects.

Market One Capital (Warsaw) is an early stage venture capital fund focused on marketplaces and SaaS, investing mainly in seed and series A.

MCI Capital (Warsaw) is one of the largest and oldest private equity funds in the country listed on the Warsaw Stock Exchange. Over its 15-year history, MCI has closed more than 60 investments. It includes 4 types of funds: MCI.Euro Ventures, MCI.Tech Ventures, Helix Ventures Partners and Internet Ventures, investing in a wide range of sectors and segments from e-commerce, IoT and FinTech to cloud solutions. MCI invests in early stage startups as well as established companies with a stable market position from Poland, Central and Eastern Europe and Turkey. Depending on the type of fund, the size of investments is up to € 35 million.

Netrix Ventures (Lublin) is a fund specializing in investing in information technology, energy, medicine and biotechnology.

Protos (Warsaw) is a fund specializing in software services, marketplaces and e-commerce. In exchange for a minority stake, they invest in companies that are at the stage of launching or expanding. Protos partnered with Point Nine Capital, Germany's leading venture capitalist.

RST Ventures for Earth (Wroclaw) is a start-up / serial fund that focuses on b2b companies, in AI and IoT.

Satus Ventures (Krakow) is a fund specializing in innovative IT projects in biotechnology and engineering.

SpeedUp Venture Capital Group (Poznan) is one of the leading venture capital firms in Poland investing in early stage startups in fintech, Internet of things and hardware. They have several foundations like Speedup Bridge Alpha supporting early stage projects. SpeedUp Venture Capital Group invests from $ 30,000 to $ 2 million.

Starfinder Seed Capital Fund (Warsaw) invests in early stage projects with global potential in three main areas: health, science and ICT. It was created in 2014 as a result of a strategic partnership with Giza Venture Capital, an Israeli-Polish investment center for Central and Eastern Europe and the Baltic Sea region.

TDJ Pitango Ventures (Warsaw) invests in startups mainly focused on Big Data, Artificial Intelligence and Machine Learning, Enterprise Software, SaaS, Mobile and Digital Media, Medical Devices and Digital Health.

Xevin VC (Warsaw) is a pre-seed and Seed fund focused on investments in SaaS, marketplaces, fintech, artificial intelligence, machine learning, advertising and educational technologies.

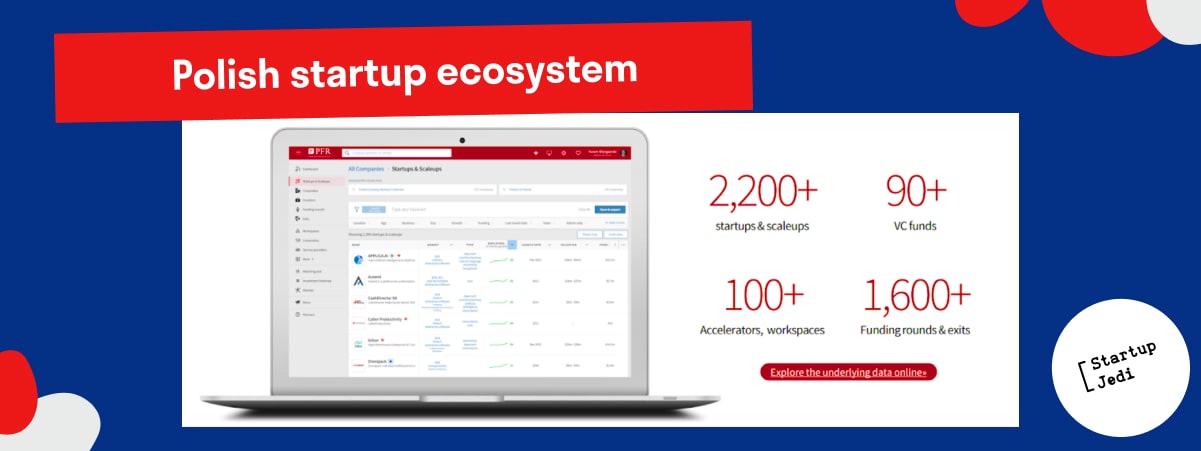

The Polish venture capital market is significantly growing with more than half of all venture capital firms being new companies supported by government-funded public-private partnerships for venture capital.

Foreign venture capital firms have also started investing in the Polish startup ecosystem. The 10 largest rounds of 2018 were held with well-known ventures such as Naspers, Target Global, General Catalyst, Enern, OpenOcean and 3TC.

Government money accounts for more than half of the available venture capital usually through grants and national programs. There is a wide range of investment support tools available to angels, angel networks, corporate funds and typical venture capital investors, both Polish and foreign.

Sources: The-Golden-Book-of-Venture-Capital-in-Poland (startuppoland.org), PARP — Centrum Rozwoju MŚP, Ekosystem innowacji (pfr.pl), Polska Cyfrowa — Ministerstwo Funduszy i Polityki Regionalnej, Startup Poland, Polish and CEE tech ecosystem outlook dealroom.co, The Warsaw Hub.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments