Startup Jedi

We talk to startups and investors, you get the value.

Startup Jedi

We talk to startups and investors, you get the value.

Continuing the publication cycle about startup metrics, I want to focus on the specific metrics for different industries and business models. Logically, it would be better to begin with SaaS-projects, as this model is lately in the right state of the Renaissance.

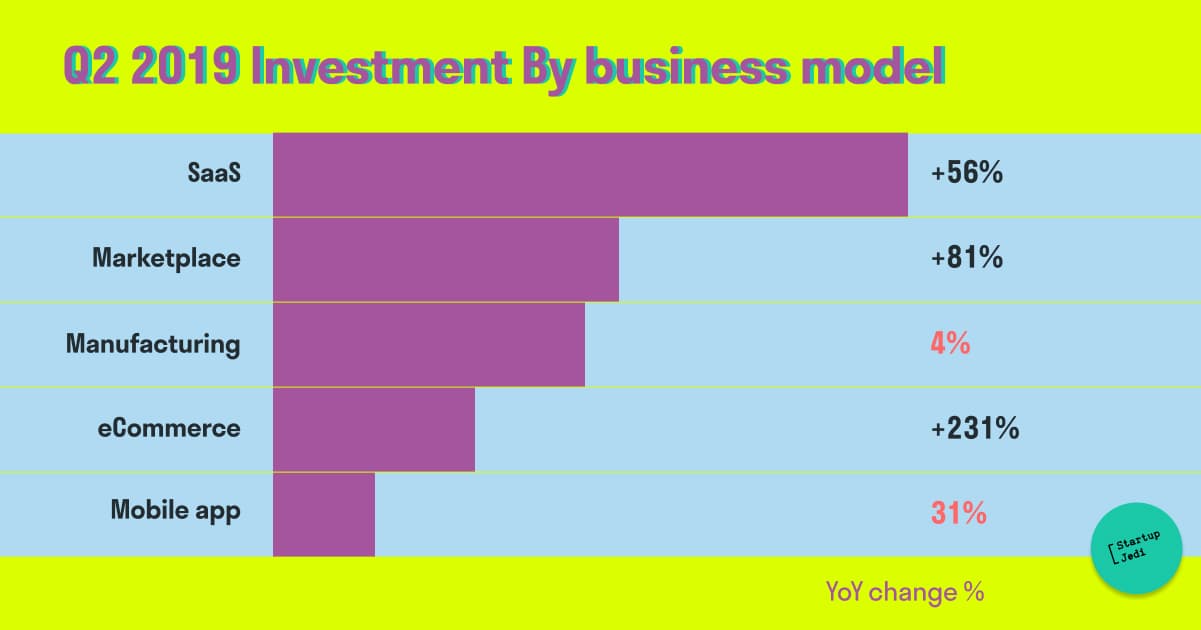

For example, in the II quarter of 2019, only in Europe there were invested approximately 4.6 billion dollars in SaaS (and, so to say, this is 49% of the overall volume of venture investments!).

Now, let’s start from the very essence of the SaaS model. SaaS models are based on constant money flows — either a client pays a subscription for using a product, or for some actions to be performed. Accordingly, the main point that should be paid attention to, both by an entrepreneur and an investor, while evaluating such a project is the “repeatability” of the incoming money flow.

...

Clients are the main source of any successful business. The more clients you have and more often they buy the products, the bigger is the revenue (Thanks, Cap!). The same goes with SaaS-projects. In the world of investments, active users are usually counted in terms of a month and a day — MAU (monthly active users) and DAU (daily active users) accordingly. It is important to track their ratio (DAU/MAU) — in dynamics, this can show, whether the clients started to use your product more often (and this can have a significant influence on whether they will pay for it in the future).

One of the most widespread mistakes that startuppers-beginners (and sometimes not only the beginners) do — is to count a website visitor as an active user. This cuts in the bud the objectivity of evaluation and disables the metric to be used while making any kind of decisions. It is essential to define which clients you can mark as active. In fact, there is no universal answer to this question, but I would recommend claiming the user as “active” when he/she does not only visit the product page but also gets some value from using it over the specific period. What to claim as a minimum acceptable value is a private matter.

...

In the previous post, I have already written about such a metric as churn — сustomer outflow. In fact, the retention metric is some kind of its closest relative. It reflects the percentage of customers, who continue to use the product after some specific period of time from the moment of purchase/installment, and that is crucial for SaaS-projects.

Methods of making the countings are different, but the minimal “gentlemen’s set” is retention of the first day, week, two weeks, month and three months. Moreover, it is desirable to consider it both in terms of quantity (meaning the number of users) and money (the amount of money that the company receives from these users: in the case of SaaS, they may not come and go, but also, for example, change tariff plans). Retention can be calculated both in calendar day and in 24-hour windows. The second method will give more food for thought, but it is more difficult, thus both of them have the right to exist.

Also, we should not forget, that there are 2 main types of retention — classic and rolling. If the first one indicates the percent of the primary users who come back on a specific day, then the second one shows the percent of those, who of them came back on a specific day or later (also, including all subsequent days). According to rolling, figures are more attractive, but it is more correct to count using the classic one. In this article, it is explained why.

Those who are very interested can generally turn the process of withdrawing retention into a cohort analysis — “cut” the audience into cohorts and derive patterns. I will not go deep into cohort analysis in this material since it deserves a separate post (and wait for it from me!)

...

Investors adore it when companies get the major revenue part from selling their products, but not the services, as the revenue from selling the services is hard to scale, the marge is lower, and what is more, it is hard to make it repeatable in the case of B2B.

In the case of SaaS, the success recipe is not only in constantly raising the revenue but also in losing as little revenue from the previously gained clients as possible. In this aspect, recurring revenue is very much in line with the previous indicator, but it still depends not always linearly.

Usually, the recurring revenue is counted for a month (MRR) and for a year (ARR). It is crucial while counting to exclude one-off payments, as they are not scaled and are not valuable while making decisions. You can count it both manually by summing up all the incoming repeatable revenue (harder, but more precise), and by multiplying the quantity of paying users on ARPU — average revenue paycheck (easier, but not that accurate). Details — here.

...

Earlier, I told what CAC and LTV are about, and how to count them, but I did it in isolation from one another. Surely, these metrics can give the food for thought also when separated, but their comparison, especially, in dynamics, gives the synergic effect.

In the case with SaaS startups there are 2 simple rules:

If you calculat the LTV/CAC and it equals 15, do not hurry to jump up and down. Read the previous article attentively and check the info, maybe you missed something in calculations. If everything is correct, still do not jump — most likely, that you have just started to attract clients from the paid sources. Test the channels, collect more information about CAC and recount the relation with a larget cohort — and may the force be with you!

I hope this article was useful to you. Calculate the right metrics correctly! Venture to everyone!

Subscribe to my Telegram channel about startups and venture invesments Born Global.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments