Startup Jedi

We talk to startups and investors, you get the value.

Attracting investments is the most important thing that a prospective startup has to do on the pre-seed and seed stages. Otherwise, a more audacious project will do it for him, get ahead of him in development and take market share. Rocket DAO is an ecosystem that helps to develop and attract investments for startups on the seed stages.

How? With the help of the acceleration program, an evaluation based on our own unique methodology and active target fundraising. And Startup Jedi media, whose article you are reading right now, is an extremely important tool in these things. Gabil Tagiev, CEO of Rocket DAO, told us how this ecosystem works, what are the perks of its startup evaluation, and how a project can get a service package worth $7 000+ for free (fair and square).

Startup Jedi

We talk to startups and investors, you get the value.

Rocket DAO works in cycles. The first one and the most important is the process of searching for projects. There are not many worthy startups and all of them are on different stages. We can be the most helpful to projects that already have a product and possibly first sales. These are startups on the pre-seed and seed stages that are open to investments up to 300 thousand dollars.

So this is how we find them:

Manually. We communicate on events, monitor media, read reports and reviews about ecosystems.

Through the partnerships. We have partnerships with High Tech Park, Angels Band, Volat Capital, Belagroprombank, friendly accelerators and foreign funds, etc.

In outsource and product companies. They more and more often launch inner startups with all that it entails. Projects are created for good sake but it is difficult for them to survive- they are created and raised in hothouse conditions. Companies don’t know what to do with them and most cases are as a suitcase without a handle: it is a pity to leave it but hard to carry anyway. What is more, such startups can be quite technical as they are solving real problems of concise clients.

Incoming applications. We receive them thanks to Startup Jedi outreach, buzz marketing and events.

With the help of positioning. it works when you precisely define your field of interest and competences.

In my case, those are definitely:

Projects interconnected with gaming as I have some experience in gamedev (Gabil is a founder of a Russian company that develops casual games with more than 100 million installations — EVA Studio, — Startup Jedi). Gaming is a perspective field but not the most attractive for investments. The paradox is that investors often do not understand how to exit such projects. The gaming field is growing, and now our most successful startups are game-related — Caer Sidi and GamePad. We understand each other and I can help the guys with their projects.

SaaS. We are already working with a few SaaS-projects, it is Altum Analytics, StROBOscope.me, Easy Bloggers and others. For example, Altum Analytics has all the most attractive things that a project may ever have: SaaS itself, predictive development object, AI. The algorithm analyzes the sales data and gives recommendations to business analytics, marketers, sales-managers on its basis. The module for evaluating the profitability of purchased traffic is also very interesting. This will not surprise anyone, but when you already understand in a few hours whether this traffic channel works or not, it looks like magic. If you understand whether your traffic will pay off in 8 hours of advertising, and your competitor in only 10 days, then he already lost.

AI in synergy with SaaS and Entertainment can generate very successful projects. This is a long-term trend, such projects attract the attention of both business angels and large venture capital funds, as they distract the picture of the world today, replacing old business models.

Chat-bots. Not just text navigation assistants but new generation bots — full mini-sites. For example, our GamePad project has created a full-featured Store in Telegram.

Of course, if interesting projects come over to our platform or our acceleration program from other industries, we will work with them as well. And for this, we will invite experts from the fields.

...

We have been thinking about training startups for a long time, have been preparing for a long time and have been working on a concept. As a result, in September 2019, the first Startup Training Camp was held, and with some improvements, the second batch of the program was closed in January 2020.

Startup Training Camp is a mentoring program organized by the Rocket DAO expert community in partnership with the business angels community Angels Band and Volat Capital investment company; the goal is to educate and train startups to attract investment.

What do we teach? First of all, we teach certain methodologies that help founders to see their startup from the side. All in the context of those elements, which we use to evaluate startups: product, market, team, business model. It is not the best option to talk about everything at this stage. Often, founders do not have a clear understanding of how things work, what to pay attention to, etc. The worst thing is when a project pops up and does not get any feedback. For example, after a pitch, somebody had doubts about the business model and pinpointed on the competitors. And that’s it. What startup has to do with this information?

By completing our program, a startup gets the necessary understanding of what to do. The CEO of Caer Sidi startup said: “Thank you, you helped us a lot. We understood what and how we have to do.” It is very important for me and I am happy because of it. My worst nightmare is not just not to help a project but also to interfere with my expertise. In Caer Sidi, we concentrated the founders’ attention in the right niche. Right after our acceleration program, guys went to Game Grow and won it. It is the essence of acceleration — everything has to happen fast.

Caer Sidi has become our first project that completed the whole cycle — from registration on the platform to fundraising, having gone through our Startup Training Camp and expert evaluation.

The teaching staff of the program consists of mentors, investors, and an expert community. We understand that after us, angels and funds will take a close look at a startup, and if we did a bad job, we will be guilty, not the project. That is why, the STC goal is to guide, point the direction, pack, evaluate and present the project to investors who are interested in, in the shortest terms. If the project is of interest but still is not on the required level, I can give a hint on what has to be done to appear in the next draft.

We continue working closely with the graduated startup and monitor the progress of each.

...

The venture capital market consists of chains, and each previous link should understand for whom it does its work. The market moves from angel investments to funds. The next round after pre-seed and seed (where angels are usually present) is the A Series, this is the round where funds are more likely to participate in. And funds are the ones who invest in already established and forecasted projects.

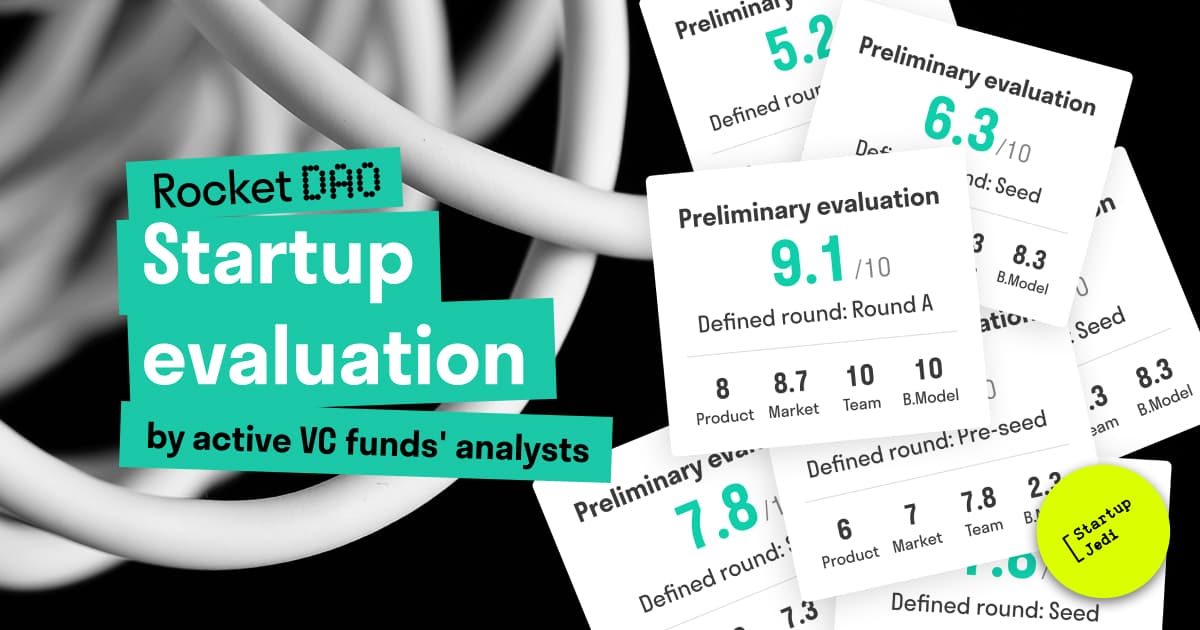

We came up with a simple logical solution: as we are working with the project, in which some funds will invest in the future, so let the analysts from funds evaluate and define the milestones of the project. It is also interesting for analytics: they evaluate projects at an early stage, and as a matter of fact, they are the first to know about the project. Perspective startups may already be noticed even at seed stages.

We use our author methodologies to evaluate startups. A founder fills in a simple and easy-to-access application, step-by-step telling about product characteristics in detail, about the market and its maturity, business model, its validity and monetization hypotheses (also the first sales), about technical, product and business team experience. Sometimes, the founder is 21 years old, and he simply doesn’t know what this metric means or he may know the required figures but doesn’t know terms. We always help in such cases: explain, give necessary advice. Therefore, this application is already a kind of acceleration, because the project is faced with new aspects in its activities, which also need to be worked out. Here you can read more about evaluation and find some advice on how to get prepared for it.

Grounding on this information, an expert evaluates a startup scaling it from 0 to 10. The major elements that we analyze are product, market, business model and team, and each section contains additional blocks. We learned how to do the evaluation on a turnkey basis in a week, and this is very fast.

Business angels who act as investors at these stages, initially didn’t have any preliminary expert evaluations, they did it on their own. And here it is, an analytic from a fund that perspectively may enter the project after angels, elaborates on all advantages and risks. Such Due Diligence has credibility and helps a good startup to attract investments. I personally am a member of Angels Band, and such business angels’ reports as mine, no one had ever seen before.

...

For every business angel, as well as for a startup, key metrics are special. At first, I look at the market and team. You can make an awesome product but if the market stagnates, you have no chances. The right people can adapt to the changing environment and pivot if necessary.

Those projects that receive Rocket DAO evaluation lower than 4–5 points, have to use this information for eliminating the faults, not for fundraising. Startups with 6–7–8 points are worth paying attention to, investors have to and must work with them. Still, I haven’t seen projects evaluated 9 or 10. To some extent, that would be strange for me:

perfect products fail perfectly.

...

Our goal is to help a project to raise an investment round. In particular:

Attract the right money on the local market.

To give local projects access to foreign capital. Investors from other countries positively perceive our evaluation. To achieve this, we tell about a project in personalized emails. If there is an interest, we act as a funnel between a startup and an investor, so we can make it out to fundraising.

By the way, venture funds start to pay cautious attention to the startups at the seed stages. A Series projects (and higher) started to be slowly but steadily “grabbed” by banks and corporations, thanks to artificial intelligence and scoring instruments. Now, by using the right tools, you are very likely to see how you can make a dollar and a half out of one dollar. So the question is: why do you need an investor? Go to a bank and take a loan — you learned how to multiply money one-and-a-half times! And you do not need to give someone a share of your potentially successful startup, and you would be able to pay the money off, according to the AI forecast.

This is a long-term trend, so venture funds which act in the classic way as we know to do so now will exist for a very very long time.

...

All startups have the same pain — a severe shortage of resources. Teams have different configurations, some lack juridical support, some — a good design. That’s why together with our partners we launched a Startup Pack program. It is a set of services that will help a startup to fill the gaps. Their total market value of the pack is about $7 000 (in perspective, there will be more partners and the value will rise to $10–15 000).

All the graduates of our Startup Training Camp, as well as the startups which have undergone evaluation on the platform, receive this pack for free. What this pack includes:

Three high-quality document templates that can be easily adapted to your project. Those are Convertible Loan Agreement, Co-founders Agreement and Agreement on the creation of objects of intellectual property. The juridical support provided by “Sysouev, Bondar and partners LLC”.

A video clip for startup presentation. Slon Media creates incredible videos that help startups from Belarus to enter tops on Product Hunt. The company offers very competitive prices with great discounts for the participants of our program.

A designer for 40 hours from 69pixels company. In a week it is possible to create a logo, make a prototype of a mobile application or lending, create groups in social media and etc.

An IT-auditor for 20 hours from PixelPlex company. Sometimes, startups choose the wrong technology stacks, an audit from the company will save hundreds of hours ahead and show how to optimize the development process.

Amazon Web Services Startup Program. Recently we became partners of the platform, so now startups which we work with can participate in AWS Activate and receive free services from the company with the total worth up to $6 500.

...

We digitize venture market players: startups, investors, experts and accelerators. We create a flow of useful information between them. Currently, there are more than 500 participants on the platform. Our goal is thousands.

The process goes pretty slowly but usually, the registration goes after a face-to-face contact, and it means that all the present are interested in our expertise. Here, it is important to have a personal network, and mass spam mailout does not work well here.

In the foreseeable future, a mechanism for online investment attraction should appear on rocketdao.io. We evaluate a startup and define the fundraising date. ⇒ Investors send their applications. ⇒ A startup chooses the lead-investor. ⇒ The lead-investor eliminates all “passengers” that cannot give to the startup anything but money. ⇒The project receives smart money on their account. ⇒ Profit! Such type of automated online fundraising is faster than a classic offline scheme.

Such solutions exist in Great Britain and Israel, however, under the guise of crowd-investing, crowdfunding actually takes place there. A person calls himself an investor and invests $100 in a project? Sounds ridiculous. It would be more useful to a startup to attract bigger paychecks from 3–5 investors, who would also be able to help with their expertise.

Rocket DAO is planning to make money out of two things:

The discussed percentage of the deal through a convertible loan in case of successful fundraising. This is more honest than taking money for the education itself. After all, the ultimate goal of our work is a successful attraction of financing by the startups.

Paid access to the startups’ evaluations. We want to create an international community of investors — an online club — the participants of which will receive high-quality, carefully selected and up-to-date information about the projects.

...

If you are not telling other people about the things that you are doing, you just live and breathe inter se. You lose clients, partners, and you don’t create your brand. When I asked venture market experts what they thought about an idea to create our own media, they were answering in one voice: “Don’t do it, you won’t make it awesome, you will just spend energy for nothing”. But we launched Startup Jedi and now I receive only positive feedback. The results exceeded all my expectations.

The coverage of publications is growing monthly. Not as fast as we would like it to, but any media doesn’t grow fast. We have narrowed the topic and formats, and this is the right decision. You can talk about startups and venture superficially, but there is already a lot of such content. Therefore, we write quality, deep and concerning articles.

We have managed to reach the regular frequency of the materials output, and we have received exceptionally positive reviews for their quality so far. We posted content on different platforms, did some experiments. And finally, we realized what we would focus on — Medium, Twitter and Instagram.

The decision to write in two languages was really on target. Initially, we wanted to make texts only in English, but not everyone is able to read freely in English. And English-language content helps us attract partners. When we wrote about the ecosystem of Estonia, the article was actively shared in Estonia. Bilingual content is an information bridge between good projects from Eastern Europe and foreign capital.

The media will continue to develop along with the Rocket DAO ecosystem. People have to understand that venture is not only about money and “ten x’s”. These are also new business processes, technical perks, trends.

...

We are in search of partners to represent our ecosystem in Kyiv and Moscow. We will be really happy to cooperate with those who have created something on their own. It is the only one cold-eye criterion — how can you teach others about things you haven’t done on your own?

We have a lot of abandoned factories — why not to attract funding and make on their basis some kind of an IT cluster with co-workings, startup-hubs, schools. Such an area in Tallinn (called Telliskivi) is so fashionable and classy that people often prefer to relax there rather than in the city center.

In Minsk, in the city with two million inhabitants, there is a place for new players, clusters, funds, accelerators. In previous years, only 2–3 good invest-attractive projects did appear in Belarus. This year there were 3 to 5 of them. I am sure that next year it will be 5–7 startups. Sooner or later, it will be about dozens.

I want to attract great interest in international money to local startups. To achieve this, we are partnering with different European and American projects. For example, with Startup Estonia, Startup Week Europe, with Russian-speaking IT-community from Cyprus (which we also described in the article not long ago). In Cyprus there is a very small number of their own startups: IT specialists come there on a payroll job, while Cypriots themselves almost never do startups. We made an agreement that we would show them our promising projects. There is money, offices of large companies — so why not?

...

If you are a startup, investor or expert who is interested in the evaluation of the startups:

register on the Rocket DAO platform;

message us at support@rocketdao.io;

If you are a company, whose services may be interesting to startups, and you are interested in the activity in this field and potential clients-“unicorns”:

contact us (via support@rocketdao.io) and we will figure out how to present you in the Startup Pack;

If you are an expert or author, and you are interested in sharing your experience, telling about other projects and trends:

contact our Chief Editor(angelina@rocketdao.io) and we will discuss how we can engage within Startup Jedi.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments