Startup Jedi

We talk to startups and investors, you get the value.

In the previous articles, we talked about the most popular startups financing instruments: Сonvertible Note and SAFE. Today we will finish the trilogy and dwell on KISS presented by 500 Startups.

Startup Jedi

We talk to startups and investors, you get the value.

KISS - Keep It Simple Security. 500 Startups claims as follows: 'The KISS docs are designed to SAVE founders & investors TIME and MONEY. They’re FREE legal docs you can use to RAISE MONEY quickly & easily, hopefully WITHOUT GETTING SCREWED'.

The document was released in 2014, one year after YC announced its SAFE.

...

There are 2 types of KISS:

Debt Version. It's a kind of an alternative to a Convertible Note and includes an Interest Rate.

Equity Version (without Interest rate or Maturity). It's supposed to be an alternative to SAFE, consequently, it doesn't include an Interest Rate.

Debt Version and Equity Version are the same except for the Interest Rate. 500 Startups suggests using an Interest Rate of 4% and a Maturity Date of 18 months.

Also, KISS contains MFN (Most Favoured Nation): if an investor enters the project at the very early stage, and later on, the startup's valuation gets lower or a startup offers more favorable conditions for future investors, then the early investor can change his terms of participation in the project into more favorable ones.

KISS is automatically converted when the company is valued no less than $1M on the Equity round. The conversion takes place as usual — at the lowest price per share, which is calculated either by Valuation Cap or by Discount.

In case when the startup is sold, the return on investments occurs either by Valuation Cap or by a Multiplier to the initial investment. The multiplier is usually 2 (this is what 500 Startups recommends: https://500startups.app.box.com/s/bqhdzjvx8x8fsn8s4zlt).

Besides, there is a Major Investor term in KISS. This title can be obtained by an investor who invests at least $50K. The privilege of the title is that at the next round of financing, those investors who entered the projected under KISS terms, are the first to be suggested to invest again, the sum of investments is 1X equal to the initial investment.

Interestingly, KISS can be transferred to any individual or legal entity, unlike SAFE.

So, the key points in KISS to be negotiated upon include:

M&A exit: 2X of initial investment amount + Interest Rate (depending on the version)

Discount и Valuation Cap: to be discussed

Interest Rate: 4% per annum (recommended)

Maturity Date: 18 months (recommended)

Major Investor Rights (follow-up): from $50К + 1Х to the initial amount of investments

Transfer rights: rights to sell/ transfer the KISS contract whenever and to anyone

MFN

Minimum Equity round: > $1M and automatic conversion

KISS closes the disadvantages of SAFE: for example, KISS includes Maturity Date, i.e. that in any case KISS is converted either automatically (on the Equity round) or by Maturity Date, unlike SAFE. SAFE is converted only when the Equity round is closed. Even if the startup is sold before the Equity round, under KISS terms the investor receives either 2X to the initial investment or an amount proportional to the investor's percentage received when converting the investment into shares by the Valuation Cap (while the SAFE investor wouldn't receive anything).

As a result, KISS is a tool that is more complex and better protects investors than SAFE and less complex than a convertible note.

...

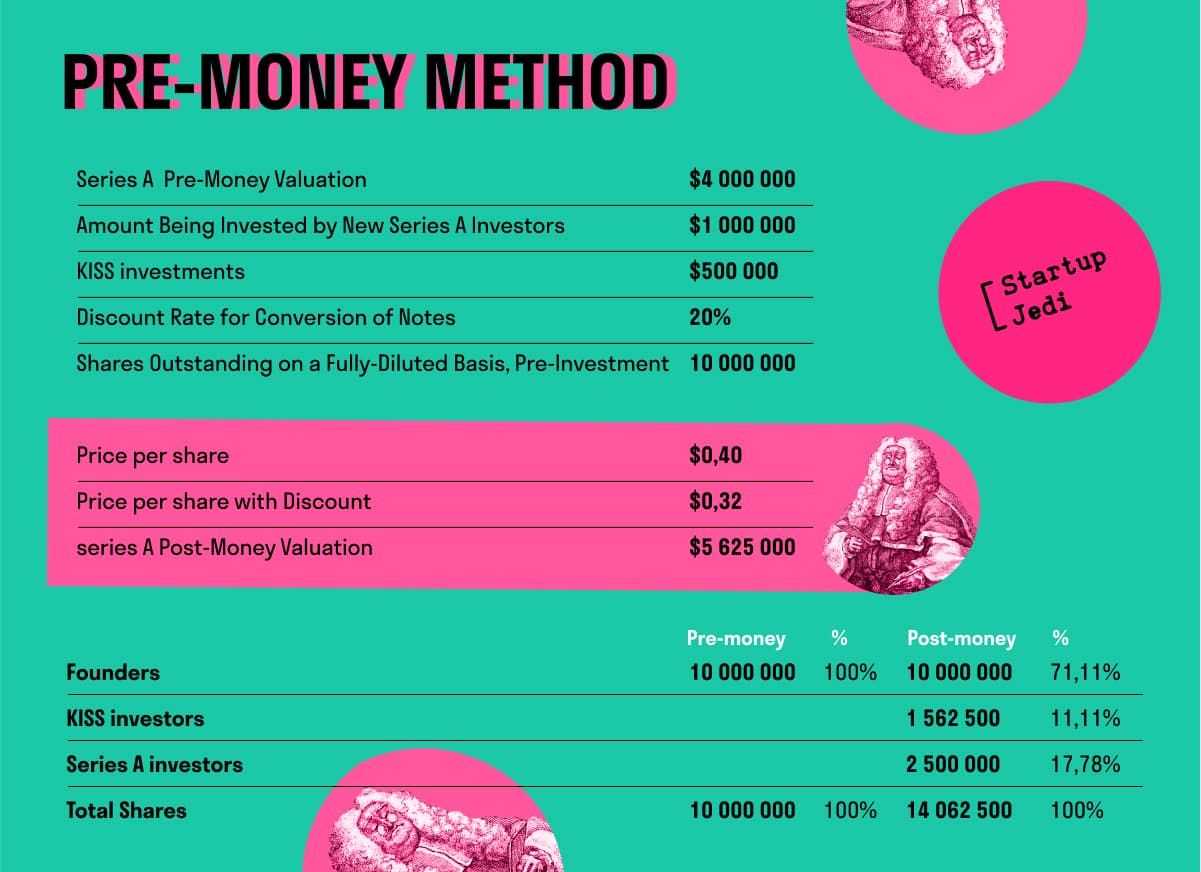

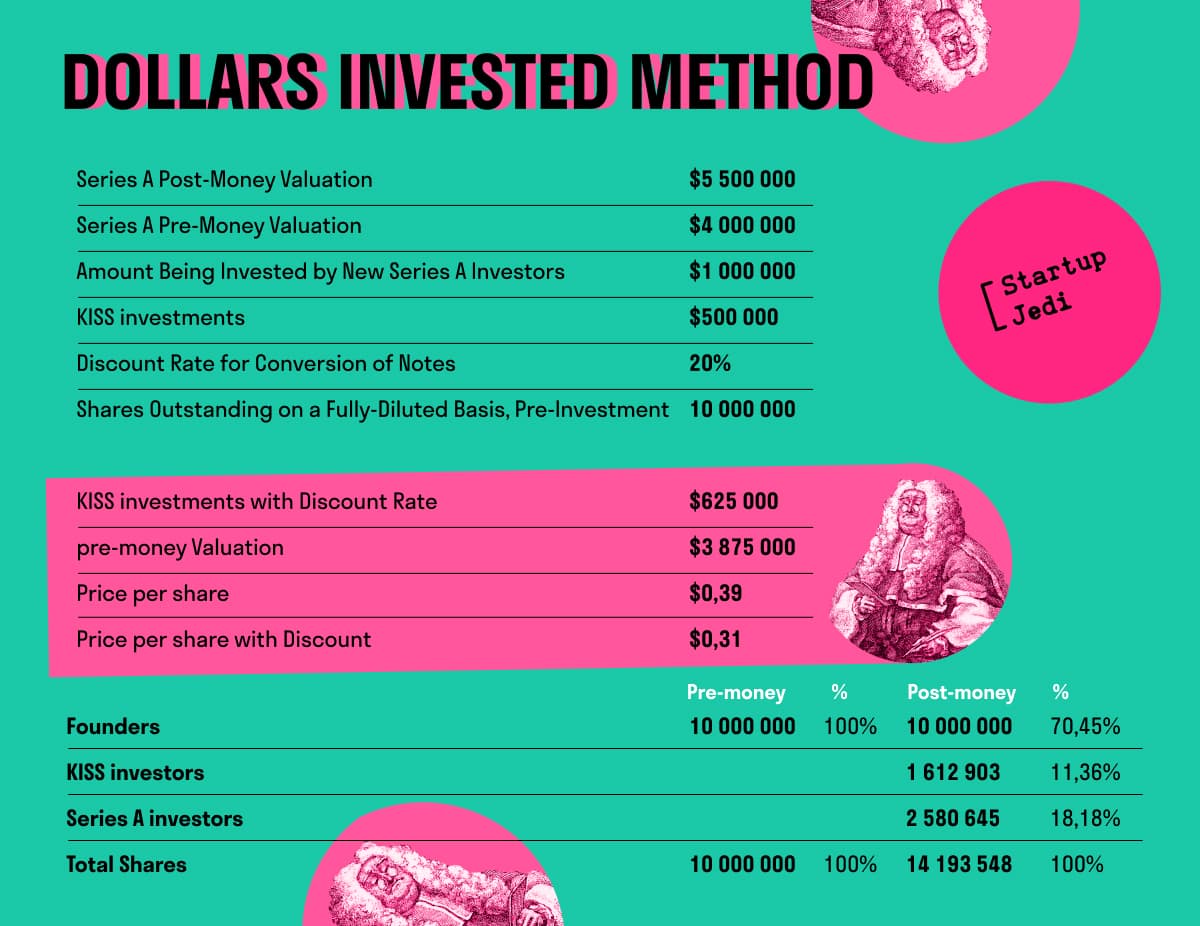

We will make our calculations not counting the ESOP (Employee Stock Ownership Plan — for more simple calculations) and Valuation Cap (we will count only the Discount).

You can study and download the document with the calculations via this link.

...

This is the simplest and most popular method. In order to calculate the price per share, one should divide the Pre-money valuation by the number of shares issued.

...

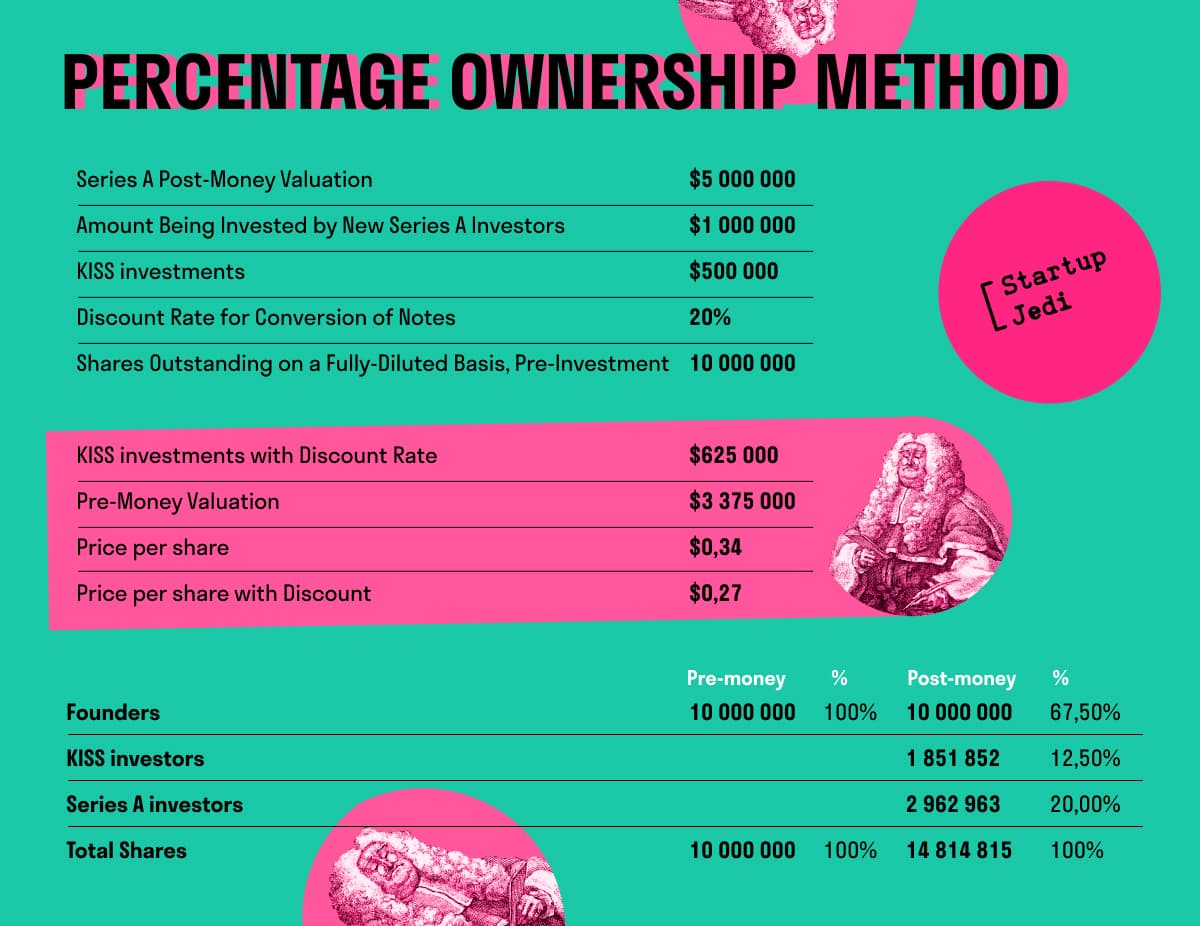

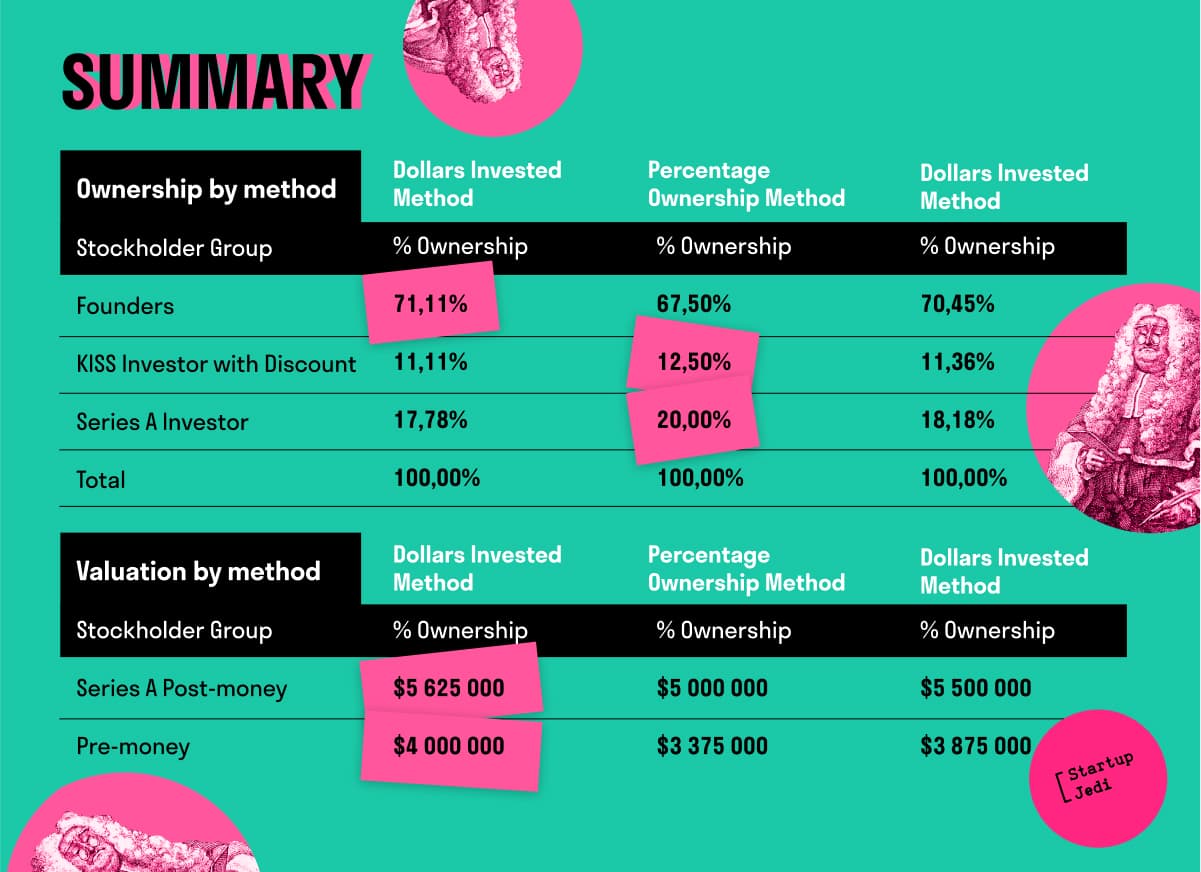

This method is used when, for example, an investor on the Equity round says that with the totally diluted shares, his share should be exactly 20% — and do whatever you want to meet this requirement. This is the most unprofitable method for founders.

In this case, the price per share is calculated by Pre-money by the formula 'Post-money — Equity round investment (in this case, Series A) — KISS investment with a Discount (or a Cap)'.

...

This method is applied if an investor proposes to use the Percentage Ownership Method (which is not an advantage for the founder) and doesn't agree on the Pre-Money Method. Here, the price per share is calculated by Pre-money using the same formula 'Post-money — Equity round investment — KISS investment at a Discount'. And Post-money is calculated as "Pre-money + Equity round investment + KISS investment (unlike the Percentage Ownership Method)'.

Comparing all the methods, one can conclude that the Pre-money Valuation method is most profitable for the founder, and the Percentage Ownership Method is most profitable for the investor.

Venture in da house!

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments