Startup Jedi

We talk to startups and investors, you get the value.

What is an IPO for an entrepreneur? An important milestone in the development of a startup, signifying its transition to the “top league” of large companies. And for investors, an IPO is another opportunity to invest and earn. We already know how fantastically the value of Apple and Google has risen since they came online, and current investors are watching closely the IPO of potential new technological giants. The number of startups is growing year by year, and the chances of investors to earn on the rise of public equity are increasing: investing in stocks at the IPO stage from a risky game is one of the best ways to make a profit.

Startup Jedi

We talk to startups and investors, you get the value.

But first things first in today's article we will:

tell you how investments are made in companies at the IPO stage;

we will explain what you need to do to participate in an IPO;

we will analyze the risks and give advice;

let's look at the most promising companies that are going to IPO in the second half of 2021.

IPO means Initial Public Offering — this is the company's first entry on the stock exchange, during which it is ready to start a public sale of its shares. An IPO is a rather long process that ends with a listing-the beginning of free trading of the company's shares. There are underwriting banks that help the company to enter the stock exchange.

How do IPOs make money? The company shares are purchased during the long process of IPO entry at a pre-market price. Then, during the public auction, the company’s shares may get higher, and if the company is already known in the world, the public offering of its shares will cause a real rush and a spike in prices. At this point, the investment pays off, the investor makes a profit. But it is not possible to resell the shares immediately at the new price: most brokers, through whom it is possible to buy shares before entering the IPO, set a certain period during which the shares cannot be sold in order to avoid speculation.

1. Registration with a broker and making a deposit

Large banks and investment funds can buy shares at the market price before the company goes to open trading. The entry threshold is set by the underwriter: when a large international company enters the stock exchange, it is tens of thousands of dollars.

In the event of the exit of less well-known companies, less large-scale investments will be needed. Private investors buy shares before entering the stock exchange through brokers — it is with the choice of a broker that this work should begin. If you have a lot of capital and the opportunity to get the status of a qualified investor, you can contact American brokers directly, if not, you can participate in the IPO through Russian intermediaries. How much do I need to deposit? The amounts vary: on average, it is from $2,000 when working with a Russian broker. The lower the entry threshold for buying shares before the IPO — the higher the commission that the broker will earn. After opening and replenishing the account, the investor fills out an application: after placing the company's shares on the stock exchange, the purchased securities come to the account, a commission is deducted in favor of the broker.

2. Getting information from the broker

By creating a personal office on the website of the broker, you get information about all nearest IPOs in which the broker can participate. Before buying shares it is important to pay attention to the lock-up period — how long you will not be able to sell shares after purchase. Each broker has a different period, from 30 to 270 days, up to an average of 90 days.

3. The decision to purchase shares

By analyzing the information about the companies that are going to conduct an IPO in the coming months, you decide to participate in the IPO of a company. What factors are worth looking at when choosing a company — let’s discuss later.

4. Possible changes

In some cases, after you have already left the bid for the share, the bid price may increase, the shares will cost more. This usually occurs when the demand for stocks is higher than the supply: for example, in the process of launching the IPO service Twitter, the initial price of shares was $17-20, but due to the high demand rose first to $23-25 and then to $26. In this case, allocation — the level of authorized purchase depends on how much shares of a given company participants can buy — can be reduced. If, for example, you were planning to buy $10,000 worth of stock, but demand exceeded supply by a factor of 5 — you can only invest $2,000. As a rule, this is a good sign: after entering open trading, the share price will grow even more, and your investment will pay off with a profit.

5. Waiting period

After the company’s IPO launch and before the end of the lock-up period, investors are waiting to see if they can make a profit. If, after the public auction, the shares of the company have collapsed, it is possible to use the so-called forward contract and sell the shares before the end of the lock-up period. For this sale the broker will get a separate commission, but this way you can reduce your losses.

However, practice shows that it is better not to make abrupt moves during the lock-up period: the shares of the company may grow in the coming months, because it depends directly on the work of the company itself. A good example is the Facebook social network: by the time the IPO process was launched, Facebook shares were sold at $38 per unit, and after three months the price had dropped to $19. At this point, many of those who had invested in the company were in a hurry to sell their shares to get something for them.

The main points by which the profitability of the shares can be understood: the price during the pre-market (before the company’s open trading), the price immediately after the IPO launch, the price after the lock-up period (how long the period — depends on the broker, but on average it is 90 days).

In general, shares of companies that subscribe to an IPO are grossly undervalued relative to their true value. This is done on purpose — the bank-underwriter and the company managers and investors benefit from creating an excess demand for shares at the time of the auction, then their price will increase significantly on the first day, and the IPO will be considered successful.

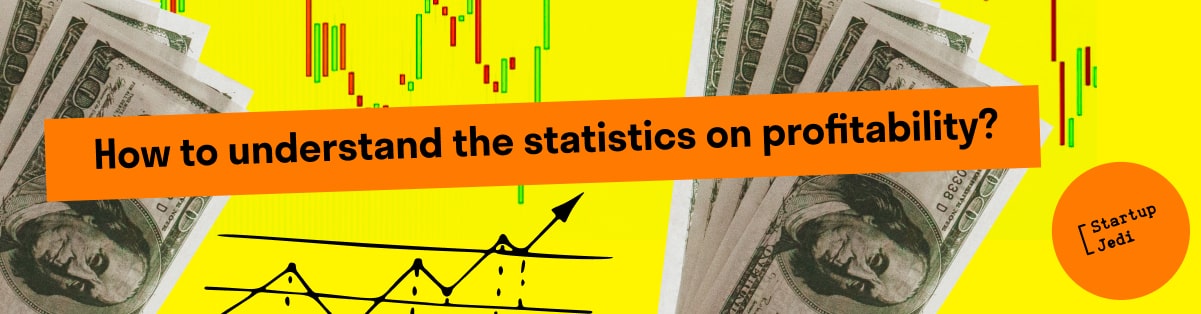

This table shows data on all three prices (premarket, exit to auction, price after 3 months) of shares of American companies that went on IPO in 2019:

The vast majority of companies showed an increase in the share price in the first 3 months. In some cases, this growth was fantastic: for example, investors who managed to invest in Roku before the IPO at a price of $14 per share, after 3 months could sell it for $54.7.

The yield of almost 300 % is a very high indicator. But there are also reverse examples (even if there are not many of them) – Qudian shares began to cost almost 2 times less after 3 months.

And the canonical example is still with the same Twitter: in the first month the shares of the company rose from the original $26 to $68, and then began to fall. Two years later, the company’s share was worth $13. And just now, in 2021, Twitter came to the current $64 per share (at the time of writing the article).

The risk level when buying shares on an IPO is inversely proportional to the size of the investor’s capital: if there is an opportunity to buy shares in several companies going to the IPO, the investor will almost certainly benefit. The choice of companies to invest should not be random: here the experience of the investor, the unbiased assessment of many factors (the company itself, its business model, teams, potential) is important, the right strategy is chosen.

There are no guarantees that the company's shares will grow after the IPO. The example of Twitter is indicative: even the excellent reputation and worldwide fame of the company may not protect the shares from falling. The stock price may be very inflated — it will fall within a few months. Whether the company's shares will be able to grow later depends on the actions of the company's management, but it is unlikely that this growth will be rapid.

Changing cost. Before the start of the IPO, the company announces the estimated value of shares, the price may change by the beginning of the sale of shares. In case of high demand, there may be a re-subscription or a reduction in the broker's limit for the purchase of certain shares.

High entry threshold. In order to invest in foreign companies entering the IPO, you need to have at least $1,000 (and better— $5 000-$10 000). Large capital helps to reduce risks and invest in several companies at once.

The IPO may not take place. Very rarely, but this happens: a company can be removed from the stock exchange for violations, a large fund can buy all the shares, or important structural changes will occur within the company.

Diversify your capital. If you invest all your capital in one company, the risks increase significantly: in general, the value of companies ' shares increases more often after the IPO, but what if the shares of this company go down? As a rule, brokers offer at least 15-20 IPO options per year during the year. Having earned money on some stocks, you can invest in others. Let every investment work for you.

Analyze the company before investing. The fall or rise of a company’s shares depends not on a blind accident, but on the real efficiency and viability of the company. Before you buy shares in the company, analyze them from all sides. Look at the rate of revenue growth (a good option — if it starts with 15-20%), look at the situation of the company’s debts, look at the list of investors, pay attention to the business model. In the long run, a good business model is more important for a company’s profitability than publicity and popularity.

Be critical of the company’s presentation. As a rule, in front of the IPO companies produce promotional videos, advertisements and even make a large road show, meeting with investors and foundations in different countries. All promotional information should be treated with caution: its purpose is to promote the company to a wide range of investors.

Don’t close your investment early. Many shares, even showing a fall in the first month, begin to rise a few months after the company’s IPO launch, thanks to the company’s own performance and efficiency. Besides, every time you sell stock early, you lose money because of a big commission.

Look at the underwriter. Large, reputable underwriters participate in the listing of the most promising companies. According to statistics, shares of companies whose IPO entry was organized by a large underwriter are more likely to grow.

The number of companies entering IPO has been increasing for several years: according to analysts, in the 3rd quarter of 2020 the number of such companies increased by 195% compared to the same period of 2019. There are many reasons for this: technological progress, digital transformation, minimum interest rates, online brokerage. This means that in 2021 investors planning to invest in IPO companies will have even more opportunities to make a profit.

Here are some promising companies whose entry on the stock exchange is planned for the second half of 2021.

Duolingo is one of the world's leading online platforms for learning foreign languages. The company has more than 40 million active customers, its application has been downloaded more than 500 million times. The company's value before the IPO is estimated at more than $3.4 billion.

Robinhood — The IPO of this company is doubly interesting, because the company is one of the world's largest online brokers. The company's IPO volume may amount to more than $ 2.2 billion.

Krafton is the largest game studio in South Korea, specializing in MMORPG (a multiplayer online role-playing game). The company’s most popular product is the online shooter PlayerUnknown’s Battlegrounds in the “Royal Battle” genre. On the stock market, the company plans to place shares totalling $ 5 billion — this will be the largest IPO in the country’s history.

Stripe — The American online payment service, created in 2011 by John and Patrick Collins. In March 2021, the company became the most expensive private company in Silicon Valley, earning $95 billion. Stripe is scheduled to be released on IPO before the end of 2021.

Rivian is an extremely promising player in the American electric car and auto-pilot market. In 2019, Rivian invested $1.5 billion in the company. It is planned that the value of the company will be estimated at US$50 billion when the IPO.

ВкусВилл — one of the largest and most famous food store chains in Russia. The brand positions itself as a chain of health food stores and enjoys great success in major Russian cities. In 2020, the company entered the international market, opening its first store in Amsterdam. In 2020, the company's revenue amounted to ₽128 billion.

Investing in an IPO company is a clearly profitable, even risky, investment. Every year, IPO investments become more and more accessible not only to large foundations and professional bankers, but also to private investors. Competition among online brokers lowers the entry threshold and improves conditions — participation in IPO becomes easier; the number of companies entering IPO increases every year, and risks can be balanced by diversification of investments.

And there is no will of chance in the rise and fall of company shares after entering the stock exchange: sooner or later everything is shown by the work of the company itself. Therefore, this type of investment is not only an opportunity to earn money, but also an interesting intellectual game, and a certain contribution to their own values: after all, large ambitious companies are driven by ideas.

Facebook: facebook.com/StartupJedi/

Telegram: t.me/Startup_Jedi

Twitter: twitter.com/startup_jedi

Comments